Business confidence is low. Uncertainty is high. Candidates are spewing whatever words they think will win that one last vote. Challengers have dropped out left and right, leaving us with 3 major contenders.

Make America Great Again. | Hillary for America. | A Future to Believe In.

Now what?

Presidential elections bring all kinds of uncertainty. Voters are choosing from candidates that have opposite policies with little to no middle ground. Businesses aren’t sure what to invest in and when the oil crisis will end. Economists are unsure of where the economy is going.

Presidential elections bring all kinds of uncertainty. Voters are choosing from candidates that have opposite policies with little to no middle ground. Businesses aren’t sure what to invest in and when the oil crisis will end. Economists are unsure of where the economy is going.

Business confidence: an economic indicator that measures optimism and pessimism that business managers feel about the outcome of a company.

Uncertainty: state where there is no objective nor are any outcomes or alternatives known.

Talking is one thing, whereas acting could result in something entirely different. If Sanders is preaching for free college, we have to assess how those words are going to work when they are acted upon. Whereas if Trump is pushing for the wall, we have to acknowledge that there is a lot more work that goes into building a wall than words can speak. If Clinton wants to have 33% of all energy sources come from renewable energy by 2020, we have to factor in the feasibility of accomplishing the goal in that time frame.

Talk is just talk. And there’s a lot of talk going on with presidential campaigns! This causes both economists and businesses to be uncertain about what to expect. When you have three strong candidates campaigning in the United States presidential elections, it can be so easy to focus in on the differences (which are many).

Economists Are Stumbling

Economist reckon that because of the vast differences of the candidates, we are about to see the most uncertain election in decades.

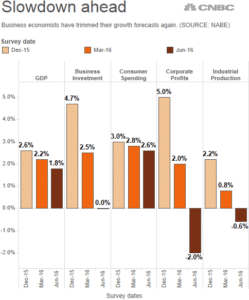

If you were to compare Trump and Sanders, it’s rather difficult to draw a direct comparison. Because of their different beliefs, economists have been forced to adjust their economic forecasts. For example, Trump is focusing on enhancing immigration laws whereas Sanders is emphasizing the need to adjust the tax code. Because of these different focuses, economists aren’t sure what to do causing severe uncertainty.

Elections Impacting Businesses

There are several macroeconomic issues that businesses witness during presidential elections: stock market volatility, currency value fluctuations, decrease in business confidence, and increase in uncertainty.

Disclaimer: We acknowledge the possibility that the economy has affected the election process (rather than elections impacting the economy). The issue of elections and business confidence is too complex to make any one assumption.

Stock Market Volatility

As the stock market becomes more volatile, investors become more anxious about making a bad investment and more conscious about making any investments at all. This results in a dip or potentially a collapse in the stock market.

According to Forbes, the Dow Jones Industrial Average is typically higher during the pre-election year out of the 4-year cycle between each election. BUT when a new president is elected, as in the case of 2016, the stock market is at its lowest of the 4 year cycle. Think of Bush in ’89, Bush in ’01, and Obama in ’09.

Value of Currency

The value of currency adjusts as a response to the change in interest rates. Each party (Republican or Democrat) has an influence on the value the US Dollar (USD). Different economic and political policies enacted by the President, among other external economic or international governmental factors, either increase or decrease the value of a dollar.

Over the past 30 years, we’ve seen inflation rates fluctuate so severely due to political elections that entire countries or regions find themselves in economic distress, a debt crisis, restricted resources, and terrible conditions for those living in the countries.

Especially during the months leading up the election and those following after the election, expect changes in value of currency.

Changes in value of currency do occur in other times than change of political command.

Business Confidence

Thomas Costerg, Senior Economist of the Standard Chartered, said that “the issue is that many candidates are ‘talking down’ the economy, affecting confidence.”

The American Institute of CPAs puts out a quarterly report that surveys businesses, CPAs, and the economy. The 2nd Quarter of 2016 Report was released recently and showed surprising results. While this report does not compare the economy/businesses to the election period, AICPA found that optimism improved from 28% to 37% in Q2 and pessimism from 34% to 21%. Inflation is becoming more of a concern now as we progress closer to election day.

The American Institute of CPAs puts out a quarterly report that surveys businesses, CPAs, and the economy. The 2nd Quarter of 2016 Report was released recently and showed surprising results. While this report does not compare the economy/businesses to the election period, AICPA found that optimism improved from 28% to 37% in Q2 and pessimism from 34% to 21%. Inflation is becoming more of a concern now as we progress closer to election day.

(Are you confident about your company’s unit economics? If not, download our free guide, Know Your Economics, to calculate your economics.)

Uncertainty

As an entrepreneur, I am part of many business organizations including the Turnaround Management Association. Financial advisors, credit advisors, bankruptcy attorneys, business owners, CFOs, and many others comprise this organization. At a recent meeting, the topic under discussion was how long we can expect the oil crisis to continue. Very quickly, the conversation turned towards the election currently taking place in the United States. The following ideas were raised during this conversation:

As an entrepreneur, I am part of many business organizations including the Turnaround Management Association. Financial advisors, credit advisors, bankruptcy attorneys, business owners, CFOs, and many others comprise this organization. At a recent meeting, the topic under discussion was how long we can expect the oil crisis to continue. Very quickly, the conversation turned towards the election currently taking place in the United States. The following ideas were raised during this conversation:

The oil crisis all depends on who wins… Who is elected as the president of the United States determines whether the oil crisis will continue beyond 2017 or will taper off mid-2017.

Business aren’t sure what to do right now because that could all change come November 8th.

Everything could change. Nobody really knows what to expect from any of the candidates at this point.

Consumers and businesses are wary about investing and spending during this time of uncertainty. In addition, new tax codes, economic policies, health insurance regulations, etc face businesses. Even adjustments to the Federal Income Tax (FIT) impacts the sustainable growth rate of a business. There is a lot of uncertainty that business owners and financial leaders face.

SWOT Analysis

These issues could have severe consequences for some companies. See these as threats. This is why during a SWOT Analysis, you complete a PEST Analysis where the first letter of the acronym is P for political.

Because of this uncertainty, bankers and economists find that companies avoid hiring or investing in large projects during the second half of an election year due to the sheer unpredictability of the situation.

Arleen R. Thomas, CPA, CGMA, American Institute of CPAs (AICPA) senior vice president for management accounting and global markets, concluded after the first quarter poll hosted by the AICPA that “company executives are clearly monitoring the potential business impact of the presidential election. But overall economic conditions and challenges for their particular industries are weighing more heavily in their calculations right now…” Additionally, Thomas claimed that more weight being placed elsewhere is “likely why [they’re] seeing little election-cycle impact on such key categories as hiring or capital spending.”

During this uncertain time, it’s useful to find economic indicators that impact your business.

What does all this mean?

Typically, we find that business owners or financial leaders stick their head in the sand during times of uncertainty. Remove your head from the sand. Know that this is happening. And prepare for anything. It will be okay. This too shall pass.

What can you do now?

First things first… Make sure that before you analyze external factors that could impact your company, you know the basics of your company. More specifically, know your unit economics. This is one simple step that you can do to ensure that you, your management, and your company know where you stand.

If your economics are out of whack, then regardless of who gets elected, your business will suffer. If you’ve checked that your economics are sound and you’re still finding issues, you might have a company that is in trouble. This could be an issue with internal factors.

If your company is still bleeding, then check out next week’s blog for the Trump Effect | Part 2.

To help you deal with this uncertainty, we want to give you a free guide, Know Your Economics, that will help you analyze the building blocks of profitability in your company. By knowing your economics, you’ll be better equipped to project the future more accurately and deal with the economic uncertainty to come.

Access your Projections Execution Plan in SCFO Lab. The step-by-step plan to get ahead of your cash flow.

Click here to access your Execution Plan. Not a Lab Member?

Click here to learn more about SCFO Labs