See Also:

Key Performance Indicators (KPI’s)

Collection Effectiveness Index (CEI)

How Does a CFO Bring Value to a Company?

Multiple of Earnings

Continuous Accounting: The New Age of Accounting

Budgeting 101: Creating Successful Budgets

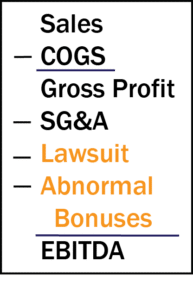

Normalized Earnings are adjustments made to the income statement in preparation to show potential buyers of the company. When making these adjustments, eliminate expenses not usually incurred for the production of the business. To show a more realistic return on investment, the normalized expenses should not appear on the future buyer’s income statement.

Different Types of Normalized Earnings

There are multiple types of special expenses that are unusual on a typical income statement. For now, let’s categorize them into two types of normalized earnings – Type A and Type B.

Type A: Non-Recurring Gains and/or Losses

The goal of “normalizing earnings” is to provide prospective buyers a typical income statement so they know what to expect. Expenses such as a lawsuit, non-operating assets, and other abnormal items that occur once are considered expenses you can eliminate when normalizing earnings.

Type B: Discretionary Expenses

Do not record certain expenses at fair market value price. Adjust these expenses so the buyer of a company does not assume these expenses incur regularly. If you include these expenses, then as the current company owners, you should specify that these expenses or earnings are not generating/generated by business. Examples include vacation homes, car rentals, startup costs, and unreasonably high bonuses.

(If you want to learn how to measure your company’s key performance indicators for free, then get it here!)

Normalized Earnings Example

For example, Laura Johnson is the CEO and founder of X company, and now wants to sell it. Her current business generated over $2 million last year, according to her income statement.

Type A: Laura experienced a lawsuit and lost $250,000. Because this was one-time event, remove the lawsuit expense for adjustment purposes.

Type B: Laura’s sales team had a sales contest to boost revenue for the year 15%. As a result, two salespeople gained extremely high bonuses totaling to a $100,000 additional salary.

By normalizing these earnings, EBITDA increases by $350,000, earnings that the buyer can potentially make without those extra costs.

[box]Strategic CFO Lab Member Extra

Access your Strategic Pricing Model Execution Plan in SCFO Lab. The step-by-step plan to set your prices to maximize profits.

Click here to learn more about SCFO Labs[/box]