As a financial leader, you look at financial statements every single day. But how do you analyze those statements?

Sometimes financial statements can appear to be just a list of numbers that are simply there for record keeping. But the true purpose of keeping and updating financial statements is to have information to make better financial decisions.

Common Size Financial Statements

Financial statements can be made much more useful by transforming the data into  percentages or ratios, also known as common-size financial statements. A common-size financial statement is a form of financial statement analysis that shows the actual dollar amounts for a balance sheet or income statement as well as the relative percentages for each one of the dollar amount items.

percentages or ratios, also known as common-size financial statements. A common-size financial statement is a form of financial statement analysis that shows the actual dollar amounts for a balance sheet or income statement as well as the relative percentages for each one of the dollar amount items.

A line item has little meaning by itself. By drawing comparisons, the value of financial statements is dramatically increased. Common-size creates an easy method to analyze financial statements.

Preparing Common-Sized Financial Statements

To create a common-size financial statement, you must first pull out your income statement and balance sheet.

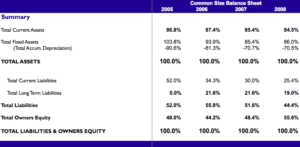

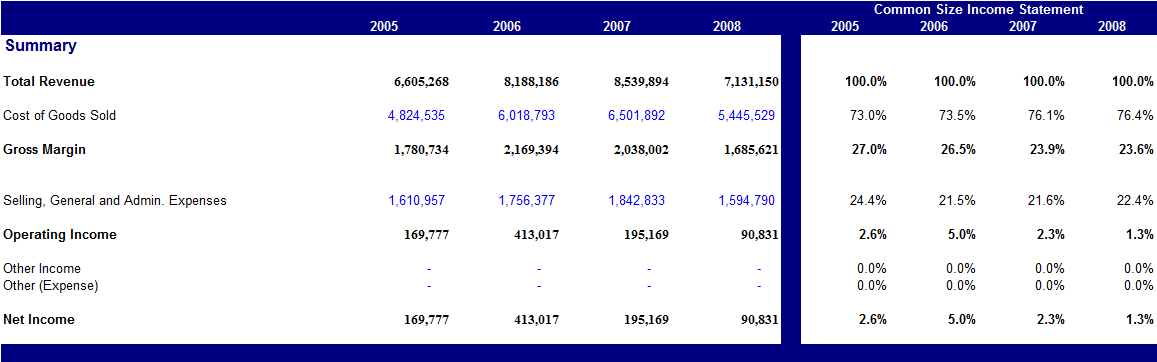

Drop in your raw data for a period of four years, then express that data as a percentage of sales for the income statement, or as a percentage of total assets for the balance sheet. Looking at the data relative to volume allows you to see where things might be slipping. You’re not looking to find 25% swings. Even a 1% slip for a $50 million company translates to a half-million dollar slide. That might get someone’s attention!

Many tools utilize common-size financial statements. One of the more useful tools is the Flux Analysis Report. The Flux Analysis Report creates a framework in which you can improve the profitability of your company by identifying negative trends in revenues and expenses, which impact profitability. As the trusted financial leader of your company, utilizing common-size financial statements and tools like the flux analysis report will allow you to provide more useful information to your CEO or organization.

Using Common-Sized Financial Statements

The value of common-size financial statements is to draw comparisons. For example, your company may be growing between 1-3% each year for 5 years. But without knowing what your ratios of fixed expenses or debt to equity are, it will be difficult to determine what type of capital you will need to grow. If your debt to equity is 70% to 30%, then your company may be highly-leveraged. In general, common-size is a mechanism that allows you to compare your company to industry standards. Research things considered to be too risky or too conservative.

It’s imperative that you utilize common-size financial statements to hold your company accountable in what it should be doing as it adjusts to changes in sales volume. Analyzing your financial statements using common-size will give you the information to advise your CEO to make intelligent decisions for the organization as well as to track progress.

Horizontal and Vertical Analysis

Common-size financial statements not only allow you to draw comparisons vertically, but horizontally. What does this mean? In a vertical comparison, a company can measure any significant changes in the financials in a quarter or year. Whereas horizontally, a company can measure whether the company is growing and if the company is maintaining the resources needed to supply the growing demand.

ACME Company grew its net income from 2.6% in 2005 to 5% in 2006. With this 2.4% increase in net income, one might assume that everything above the line increased by the same percentages. What you won’t see easily looking at the raw numbers is that gross margin actually went down .5% over the period due to increased COGS. The improvement in net income was due to a decrease in SG&A as a percent of sales, despite an increase in raw SG&A dollars.

In order to make a difference, you have to look at the numbers differently.

Access your Strategic Pricing Model Execution Plan in SCFO Lab. The step-by-step plan to set your prices to maximize profits.

Click here to access your Execution Plan. Not a Lab Member?

Click here to learn more about SCFO Labs