Coaching the Entrepreneur: Learn how to know what you don’t know.

How much should I spend on accounting for my company?

I have been in the accounting profession for 32 years, and for the last 6 years, I’ve owned my own consulting firm to assist companies with accounting challenges. There is one common theme that I continue to be amazed by when it comes to accounting and Entrepreneurs. They DO NOT want to spend money on professional accounting.

To be fair, no one wants to spend more money than they have to. On anything! No one likes overhead, and most businesses focus on SALES. We all want to minimize SG&A (Sales, General, and Administrative).

Why? Well, SG&A doesn’t produce any revenue. Unless your sales team and their commissions are in SG&A. Office supplies, your receptionist, and HR person do not generate revenue, or add to net income.

What about your accountants? Do they generate revenue?

Here is the answer: Your accountants will likely never be involved in a sale. BUT, a very good accounting team will eventually add to the bottom line. They will add to your net income. They might even pay for themselves.

“What!? How is that possible?” Asks the entrepreneur. “How can an accountant add to the bottom line? That’s impossible.” It’s very possible! Let me clarify what a CPA is first.

The following is another another common theme I experience with Entrepreneurs: When I first meet them they almost always mention “my CPA…” and I immediately know they are referring to the CPA who does their taxes. This person is usually the first trusted advisor the entrepreneur meets, and they prepare the required tax return for the business. What the entrepreneur does not know is that CPAs come in all different flavors, or specialties. There are tax CPAs that focus on audits, valuations, internal controls, forensic accounting, turnarounds, M&A, estate planning and many more areas of accounting. That being said, these are not the CPAs who should handle managerial accounting, or cost accounting and financial reporting.

Let’s get back to the cost of accounting, and accountants adding to the bottom line...

In my career, I have seen dozens of examples of how a good accountant or accounting team has added to the net income of a business. In fact, they’ve added MILLIONS of dollars of net income and added to the bottom line.

Just in the last 24 months I have watched our own accountants add to the net income of our NearSourcing clients. Here are some examples:

- The accountant identified the correct accounting principles to apply to the business based on ASC 606 and recognized $2.2 million of revenue in 2022 for a manufacturing company.

- The accountant realized that the materials purchased were being expensed instead of being capitalized on the balance sheet. The result was an improved gross margin and higher net income. $1.8 million added. (We have two companies in the last 24 months)

- The accountant identified large maintenance expense that should have been capitalized and this added to the net income. (We have three companies in the last 24 months)

- The accountant identified a trend of growing SG&A as a percentage of sales while the company experienced high growth. Management was looking at whole dollars, not as a percentage of sales. As a result, Management was able to right-size SG&A and this added to net income.

I could go on and on! A good accountant will add to net income. So, before you call your accounting department “Overhead” and not a “net income producer” … think again!

Unfortunately, I have also seen the opposite. The lack of a good professional accounting department has caused the following:

- Incorrect margins

- Overstated revenue

- Improperly valued inventory

- No management of working capital

- Cash poor

- Write off gains that should have never been booked

- Horrible experience changing accounting systems

- No visibility into the past or future

- Embarrassing conversations with your banker

- Financially distressed businesses

- The CEO business owner loses sleep about his lack of having correct visibility about margins, cash flow forecast and no financial strategic planning

In most cases, this is caused by a bookkeeper producing the financials. Bookkeepers are an essential part of the accounting department, but they are typically not CPAs. They can generate the built in reports from whatever accounting system is used, but they don’t apply U.S. GAAP accounting principles to them.

How do I get my accountant to be a Net Income Producer?

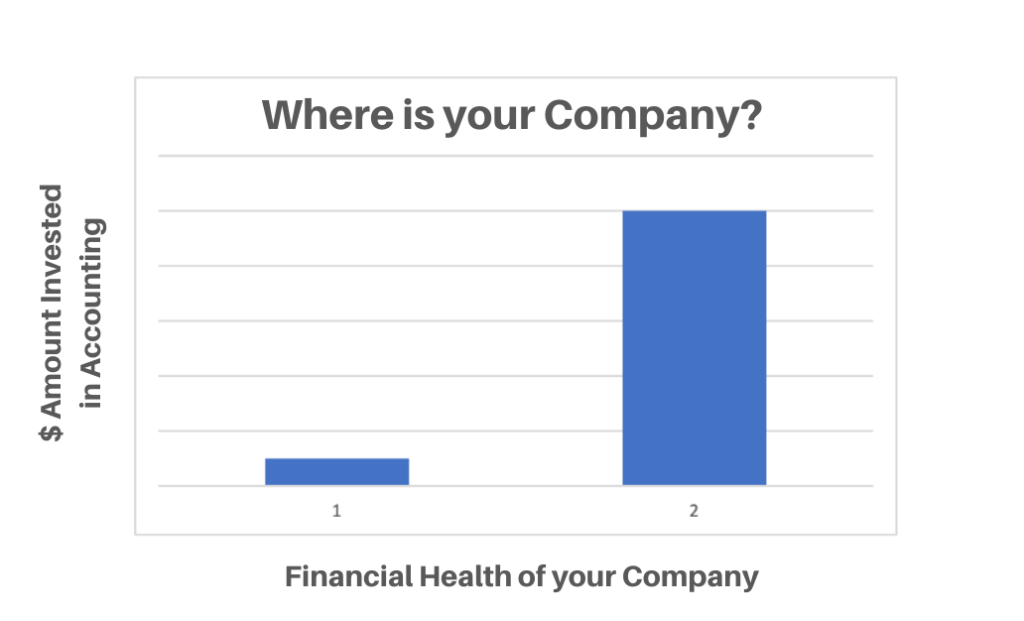

You have to spend money to make money. We often meet Entrepreneurs who struggle to understand the need for proper accounting or justify it’s worth. That is the main goal of this article, to shift their perspective.

Unfortunately, many entrepreneurs don’t know what they don’t know. They think that by spending $1,500 per month for a bookkeeper they can get the accounting done correctly. For $1,500 per month, you will get a person that breathes and enters data into a system. You will NOT get accounting and financial records that make sense and represent your business based on U.S. GAAP… The entrepreneur thinks that if there is money in the bank all is well. Which could be true… Or maybe not. We have watched millions in the bank go quickly as lack of working capital management had a negative effect on cash. Eventually, you will need to produce U.S. GAAP financials for some institution. That is usually where we come in.

This article is for the entrepreneurs that started a business, and now have $10 million, $20 million or more in sales. As your company grows you will have different financial requirements and you will need to invest in your accounting department. Don’t be a penny wise and a pound foolish! Take a look at successful companies around you… private or public. You will find there are no financially healthy companies that do not invest in their accounting departments.

A Financially Healthy Company

A Financially Healthy Company is one that has strong working capital, positive cash flow, and profitable net income. They know their margins on individual projects, and they know their margins as a whole. Inventory is properly valued; they have financial reports and tools that are timely. They have a healthy balance sheet. They project and manage working capital and cash accurately. The managers and owners have peace of mind because they know what the numbers are, and as a result, they sleep well at night. They don’t worry about margins, cash or the next big project. They focus on sales and strategy.

When I say invest, I mean they spend a significant amount of dollars on a strong CFO or Controller, and the rest of the accounting department. If the company is larger, they will have both a CFO and a Controller with very strong accounting department. These employees make good salaries, rightfully so.

You simply cannot have a Financially Healthy Company with professional accounting and U.S. GAAP financials without spending money. Sorry, but your $1,500 per month bookkeeper and consulting with your tax CPA will not get you there!

What do I get for investing in a strong accounting department?

- An accounting department that will add to net income

- Financial statements that truly represent your margins and that you can show third parties such as banks, insurance companies, partners, shareholders, regulatory agencies

- Timely financial tools that will provide you information so you can manage your business

- Budgeting and forecasting of cash flow, P&L, balance sheet per U.S. GAAP

- Margin analysis by project and as a company as a whole

- Financial analysis

- Peace of Mind!!!!!!

You don’t have to go broke investing in your accounting department. It can be achievable and affordable with the right outsourced accounting team, and will always pay for itself in the end. Learn about how NearSourcing Accounting Solutions can help.

“THERE ARE NO FINANCIALLY HEALTHY COMPANIES OUT THERE THAT DO NOT INVEST IN PROFESSIONAL ACCOUNTING” Dan Corredor