Oftentimes, CEOs don’t see the value in a CFO… They ask “how does a CFO add value?” After hearing that countless times, I want to let you on a little hint.

A good CFO improves profitability and cash flow 1-2% of sales.

A few months ago, I was meeting with a young man named Nathan who was about 8-10 years into his career. Nathan had achieved his dream by becoming the Director of Finance for a mid-size entrepreneurial company. What could go wrong?

Nathan started getting frustrated because the company would not value him as a financial leader. They saw him as overhead. Leadership thought he could do more. They didn’t respect him. The financial leg of the company saw him as a cost center. Have you ever been in the same boat as Nathan?

Very quickly after his promotion to this position as Director of Finance, Nathan began to regret taking the offer.

How do you go from “overhead” to valuable?

Let’s go back to my simple answer: a good CFO should improve profitability and cash flow 1-2% of sales.

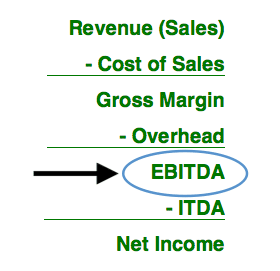

Increasing EBITDA

Most CEOs see CFOs as overhead, especially when they don’t make a positive difference to the bottom line, or EBITDA. Before Nathan was promoted to Director of  Finance, there wasn’t anyone in a financial leadership position in the company. The company wasn’t financially managed.

Finance, there wasn’t anyone in a financial leadership position in the company. The company wasn’t financially managed.

In the case that there is no CFO or the past CFO was not successful as improving profitability and cash flow, it is reasonable to expect the new CFO to improve profits and cash flow by 1-2%.

For ease of explanation, we’re going to focus on increasing EBITDA simply because it’s difficult to mitigate interest, taxes, depreciation, and amortization. There are only a few ways to increase your EBITDA: increasing sales, reducing overhead and improving cash flow are some of these.

(Need to improve your cash flow? Download your free 25 ways to improve cash flow!)

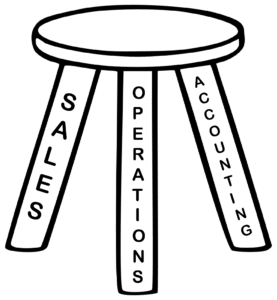

It’s often said that the CEO drives sales and the CFO manages everything underneath that! It couldn’t be said more perfectly. But there’s one thing that I don’t necessarily agree with. If the CEO is only managing sales (keep in mind that you have to spend money to make money) and the CFO is managing operations and accounting, there’s an imbalance in financial management.

(Click here to read a case study to price for profit while utilizing the 3-legged stool example you’re going to read about below.)

A 3-legged Stool

You probably figured out now where we’re going with this. A 3-legged stool has… well 3 legs! Each leg is imperative for the seat to stand horizontal. People rely on there being 3 legs so they can rest and sit on the stool.

Sales, operations, and accounting go hand in hand. Revenue allows for the company to continue to operate. Operations fulfills the sales orders. But if you accounting doesn’t manage cash flow, then operations can quickly spend more than is coming in. If cash flow isn’t managed, sales could sell either at a loss or without collecting for x amount of days resulting in no cash.

#1 Reason Why Businesses Fail: No Cash

Cash is king. So if cash is so important, then why are financial leaders not valued?

Typically, companies see financial leaders as the weak link. Others in the organization don’t know their value.

How should financial leaders be valued?

What gets measured gets managed. If you’re not even looking at your records (i.e. historical data), then you’re probably not going to use those numbers to run your business.

A CFO needs to ensure that operations has enough cash to purchase inventory to produce the products that sales needs to sell. If the CFO is not working with the sales force to project sales, then you will easily miss sales targets. Thus, this results in miscalculated inventory levels. Suddenly, the company is dealing with angry customers and no cash.

In short, the CFO is important. While a 1-2% improvement may not sound like much, a CFO of a $50 million company could add $500,000-$1,000,000 worth of value to the company. The value added in this case will certainly cover their salary and then some.

Just like a CEO can increase his or her salary by increasing the size of the company, a CFO can increase his or her salary by improving profitability and cash flow. This is typically why the larger the company, the larger the salary. 1-2% of a $50 million company is a lot different than a $100 million company. If you as the CFO are able to add enough value to the company to cover your salary and then some, it’s hard for others to argue that you aren’t valuable.

Case Study

A couple of years ago, I had a client, Rob, that owned a $135 million distribution company. Over time, Rob has accumulated a massive amount of inventory. When I went to find out where the company was bleeding, I identified that Rob’s cash conversion cycle had jumped significantly over the past 4 year period.

A couple of years ago, I had a client, Rob, that owned a $135 million distribution company. Over time, Rob has accumulated a massive amount of inventory. When I went to find out where the company was bleeding, I identified that Rob’s cash conversion cycle had jumped significantly over the past 4 year period.

Rob and I were able to free up and reduce his daily sales outstanding (DSO) from 180 days to 90 days. This freed up $4 million in liquidity! By freeing up cash, Rob was able to add value to the company.

This is only 1 of the 5 ways to improve your cash flow that is included in our free white-paper!

If you are seeking to add real value as a financial leader, click here to learn the 5 Ways a CFO Adds Value.

Access your Cash Flow Tune-Up Tool Execution Plan in SCFO Lab.

Click here to access your Execution Plan. Not a Lab Member?

Click here to learn more about SCFO Labs