Growing up, I constantly heard the old adage, “money doesn’t grow on trees.” It’s meant to warn people that there is only a limited amount of money available to put to use. It’s easy to fall victim to the notion that any problem can be solved if you spend enough money on it.

Growing up, I constantly heard the old adage, “money doesn’t grow on trees.” It’s meant to warn people that there is only a limited amount of money available to put to use. It’s easy to fall victim to the notion that any problem can be solved if you spend enough money on it.

But, what happens when you go so far down a road that you’re unable to see yourself out? Sometimes, it seems like the only option is to pay someone to guide you back where you belong.

Through personal experience, I know that this option can run you dry and ragged. Keep in mind that there are incredible consultants out there that have made major positive impacts in my company. However, acting out of desperation can get you into some trouble if you don’t think things through.

Do you ever find yourself throwing money at your problems?

The Problem

Companies never seem to have enough cash (unless you’re Google or Apple). In addition to this cash shortage, roadblocks and problems seem to consistently pop up.

While it’s true that you have to spend money to make money, what if you find that you are continuing to spend money without seeing a comparable return? This is when we run into the problem.

Me

A few years ago, I had a big project that I was set on making a success. After a few months, my team had lost traction and we weren’t seeing any growth. Instead of doing the dirty work myself to find out what the real problem was, I hired a consulting firm to help us without vetting multiple firms.

[quote]When you find yourself in a hole, stop digging.[/quote]

While trying to avoid making mistakes in troubled times, I found myself standing at the bottom of a hole.

Langley & The Smithsonian

Aviation started out as a hope and a dream to many. The Smithsonian Institution put forth a hefty budget in order to get recognition as the first to pilot an aircraft.

Aviation started out as a hope and a dream to many. The Smithsonian Institution put forth a hefty budget in order to get recognition as the first to pilot an aircraft.

In the late 1880s through the early 1900s, Samuel Langley had been extensively researching aeronautics, hoping to be the first man to pilot an airplane. Throughout his career, he was set on progressing from flying planes un-piloted to him piloting the planes.

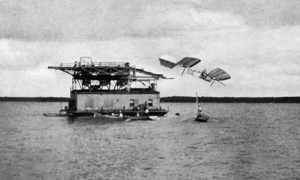

In 1903, the United States government, backed in part by the Smithsonian, awarded Langley a $70,000 grant to expedite his progress. That October, Langley and his team launched the first “heavier-than-air” aircraft with a pilot in the cockpit. There was so much excitement as many stood to witness the “first flight”. Within seconds of being catapulted, the aircraft took a nosedive into the water.

Two months later, Langley and his team once again failed as the aircraft toppled over the catapult launch pad into the water.

Langley researched, tested, destroyed a lot of equipment and exhausted the budget given to him by the government and the Smithsonian. He no doubt felt, as do many companies still, that if he threw sufficient resources at the problem he could arrive at a solution.

Sound familiar?

Ingenuity

Cambridge Dictionary defines ingenuity as “someone’s ability to think of clever new ways of doing something.” Oftentimes in the business setting, we find that the company is so focused on the mundane tasks of day-to-day operations that it fails to optimize and facilitate a creative environment.

Having ingenuity imbedded into the culture of a company is imperative for an organization to beat out its competitors. Apple didn’t become a $53 Billion (net income) business without having clever founders that defied the four walls encapsulating technology in the 1970s and 80s.

When you stop throwing money at your problems, ingenuity is required to adapt to be more forward thinking.

The Wright Brothers

The Wright Brothers

9 days after Langley’s second failed attempt, the Wright brothers flew their plane 852 feet in 59 seconds. This became the first manned flight.

The difference between the success enjoyed by the Wrights and Langley’s failure… Budget.

Langley had an easier environment to work with, setting himself up for success. The Wright brothers did not have an easy environment that would help them better succeed. The Wright Brothers only spent $2,000 of their hard-earned money to create the first piloted aircraft capable of sustained flight. In comparison, Langley and his team at the Smithsonian spent the $70,000 grant and failed.

Because the Wright brothers were working on a shoestring, they had to rely on innovation and perseverance. They had the same goal as Langley. Money wasn’t the factor in their success, but their ingenuity and refusal to give up.

More money does not equal a greater chance of succeeding.

How You Can Avoid Throwing Money At Your Problems

In a panic because cash is tight or you’re facing problems? It could be that your basic unit economics are upside down.

There are three ways that you can avoid throwing money at your problems. Those include assessing your 1) profitability, 2) cash flow, and 3) unit economics.

#1 Assess Profitability

To stay in business you have to be profitable. So you’re making boatloads of sales. But is that revenue going to drop down to the bottom line? Or are you going to find that your revenue is tied up in your cost of sales and overhead?

When assessing your profitability, there are 2 metrics that you need to key into: return on assets and profit margin. If you find that these key items are turned upside down, you need some help.

Help can come in a variety of ways. To prevent you from throwing money at your problems, talk to your mentors, vet consulting firms before you sign the contract, use your internal resources to investigate and strategize solutions.

#2 Assess Cash Flow

I always say it… Cash is king!

If you run out of cash, default will be the ugly monster coming towards you. Start by unlocking cash in your business.

Another way to improve cash flow when in a tight spot is to analyze what collections ratios you are using, CEI or DSO. I’ve recently found that while they are both valuable for particular situations, using Collections Efficiency Indicator (CEI) is sometimes a better way to track your accounts receivable.

#3 Assess Unit Economics

Throwing money at the problem won’t change bad economics. Unit economics are the most basic function of a business. Without good economics, you can’t make money no matter how much you sell.

Want to check if your unit economics are sound? Download your free guide here.

Connect with us on Facebook. Follow us on Twitter. Become a Strategic CFO insider.

Access your Projections Execution Plan in SCFO Lab. The step-by-step plan to get ahead of your cash flow.

Click here to access your Execution Plan. Not a Lab Member?

Click here to learn more about SCFO Labs