Do you sometimes feel that the value you bring to your company is worth more than your salary? In the business world, often expectations exceed compensation, especially with financial leaders. What does the role of a CFO actually look like?

Before we dive deeper, it’s important to ask some questions:

Are you the person that your CEO contacts to “fix the problem”?

Have you been told to figure it out even if you don’t know how to fix it?

Are you responsible for learning the skills to fix that problem?

If you answered “yes” to any of the above questions, you may be someone who is “wearing too many hats.”

Wearing Too Many Hats

Often, CFOs will find themselves wearing too many hats due to problems within the company. The CEO’s solution is usually to generate more volume, but resources don’t generally increase proportionately. Most of the time, this means that the CFO takes on more responsibilities in response.

This isn’t always a good thing. Sometimes the company depends so heavily on the CFO, that the CFO feels unappreciated or that he/she deserves more money or esteem.

This past Friday, I moderated a panel of 3 financial leaders in various industries to discuss the issue of wearing too many hats. I’ve put together a summary of what issues were raised among our panelists as well as the Houston CPA Society’s Conference attendants. The discussion was so interesting and enlightening, we’re dedicating the next few blog posts to the highlights of what the panelists shared.

Life Cycle of a CFO

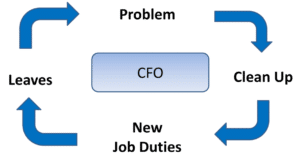

At the heart of this juggling routine is what we call “the life cycle of a CFO“.

The notion that CFOs had a “life cycle” came to me through observation over 25+ years of consulting with entrepreneurs and their companies. This cycle is comprised of 4 stages: a problem arises, cleanup occurs, new duties are assigned, and the CFO burns out or looks for greener pastures.

Problem

The life cycle of a CFO begins with a problem within a company. The company has grown beyond the capabilities and skills of the current employees. To solve these problems, the company hires a CFO on the team (either temporarily or permanently).

Clean Up

From there, the CFO cleans up the company’s financial processes and gets the systems up to speed. The problem is fixed – so now what?

Often, the CFO finds himself/herself filling time and justifying their existence once a problem is resolved.

New Job Duties

The CFO will pick up new job duties, help out other departments, etc. It’s only a matter of time until the CFO realizes that his or value is worth more. The real question becomes how to add value as a CFO.

At this point, the CFO is wearing the janitor hat, the insurance agent hat, the HR hat, the banker hat and the CFO hat (and possibly others depending upon how good/willing they are).

You can probably guess what happens next.

Say Bye-Bye!

So the CFO leaves, either for a more challenging position or, if they’re too stressed out with multiple duties, settle for something less. Most companies won’t rush in to fill the void left in their wake, and so the cycle begins anew…

What Hats Do You Wear?

As I mentioned, I recently moderated a panel discussion at the Houston CPA Society’s CFO/Controller Conference. During this session, I asked the panel many questions including what hats they wore within their companies, and how that posed challenges in their work experience.

Determining your Role

One panelist, Derek, mentioned that he had to balance both operational and financial roles in his company. They hired Derek to handle both of these roles. This illustrates how the role of a CFO has evolved over the past 25 years. As the role of a CFO changes, the relationship between the CEO and CFO changes.

Learn more about how to guide your CEO as a trusted advisor by downloading your free guide on How to be a Wingman.

Derek mentioned that the job was particularly difficult because he had no definitive role or expectations. He found it challenging that he didn’t know how the typical day is, what reports were required, or where to find the information to solve these issues.

Determining his daily role within the company become a task in itself. Especially as he stepped into higher levels of financial leadership, there were more moving parts that hadn’t been defined.

Finally, he concluded that delegation was the hardest because he was bogged down in cleanup. He felt like a janitor; going behind people and literally cleaning up their messes. Delegation is extremely important as a financial leader. In Derek’s words, “Delegation was important to me to further my role in the company, and to take on multiple other jobs.”

“The Job Man”

The next panelist, John, had a different situation than Derek. John is the CFO of an engineering firm. Rather than working an operational job, John calls himself “The Job Man.” He receives all the jobs that nobody else wants.

John looked at this from a positive standpoint. In order to continue working as a valued asset to the company, you must learn not to say no. In this ideology, there is nothing in your realm that you cannot do. This stance is interesting; not everyone is usually as optimistic.

If there is a problem left unaddressed, it will grow into something uncontrollable. John commented that he prefers that the issue is resolved so he can go on with his business. Take action; address it; knock it out. John’s thoughts, “I’m the one that gets all the jobs that nobody else wants. You’ve got to learn not to say no.”

How high can you stack the hats?

Paul, the third panelist, mentioned a great point: in any small to medium sized company, you’re always going to stack hats. The questions is, how high can you stack them before they fall (or your neck snaps under their weight)?

Upon hiring a CFO, a company interviews to see what you can bring to the table (i.e. the right amount of relationships with banks, the IT skills required to be a financial leader in the company, knowledge of your financials). You’re sharing everything in your bag of tricks not realizing that they are listening most attentively. How can you be surprised when they take you up on your special skills?

Despite your amazing skill set, you can’t do it all. So to keep the hats from crashing down, which hat would you give up?

The Most Important Hat

No matter what hats you wear in your company, the most important hat is wingman to your CEO. Business owners care more about the value you help them bring to their company and your financial leadership than they do compliance and caution.

To extend the life of a CFO, it crucial for the CEO and CFO to partner together. As a CFO, you are in the unique position to understand all that is necessary to keep moving the company forward.

Conclusion of Part I

Our panelists highlighted the importance of determining your role, taking action to learn new skills, and focusing your skills within the company. While you may sometimes feel like you’ll topple over under the weight of all the hats you wear, remember to focus on what’s really important – having your CEO’s back.

Next week, get the panelists take on what millennials bring to the table!

If you’re interested in becoming the trusted advisor your CEO needs, download your free How to be a Wingman guide here.

Access your Projections Execution Plan in SCFO Lab. The step-by-step plan to get ahead of your cash flow.

Click here to access your Execution Plan. Not a Lab Member?

Click here to learn more about SCFO Labs