See Also:

EBITDA Valuation

Calculate EBITDA

Valuation Methods

EBITDA Definition

Multiple of Earnings

Adjusted EBITDA Definition

Adjusted EBITDA is a valuable tool used to analyze businesses for the purposes of valuation and potential acquisition. Many also call it Normalized EBITDA because it systematizes cash flow and deducts irregularities and deviations. Use adjusted EBITDA as an additive measure to determine how much cash a company may produce annually and is typically used by security analysts and investors when evaluating a business’s overall income; however, it is important to note business valuation using Adjusted EBITDA is not a Generally Accepted Accounting Principles standard. As a result, do not uses it out of context as various companies may categorize income and expense divisions differently.

EBITDA stands for Earnings Before Interest, Taxes, Depreciation and Amortization and is a meaningful measure of operating performance as it allows businesses and investors to more fully evaluate productivity, efficiency, and return on capital, without factoring in the impact of interest rates, asset base, tax expenses, and other operating costs.

Adjusted EBITDA is a useful way to compare companies across and within an industry. Many consider it a more accurate reflection of the company’s worth as it adjusts for and negates one-time costs such as lawsuits, startup or development expenses, or professional fees that are not recurring, just to name a few. More importantly, adjusting EBITDA often reflects in a higher sale’s price for the owner.

Adjusted EBITDA Margin Calculation

Adjusting EBITDA measures the operating cash flow using information acquired from income statements. Measure it annually. But when you average it over a three to five year period in order to account and adjust for any anomalies, it is most beneficial. Generally speaking, a higher normalized EBITDA margin is preferred, and the larger a company’s gross revenue, the more valuable this new measurement will be in a future acquisition.

Are you in the process of selling your company? The first thing to do is to identify “destroyers” that can impact your company’s value.

Download The Top 10 Destroyers of Value

Typically, analysts will then normalize or adjust the standard EBITDA by considering other expenses outside the operating budget. Adjusted EBITDA is found by calculating the Net Income, minus Total Other Income (Expense), plus Income Taxes, Depreciation and Amortization, and non-cash charges for stock compensation.

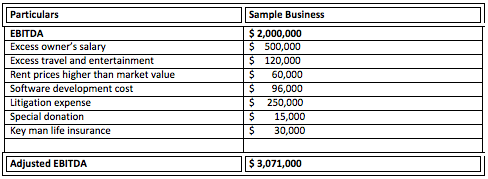

At this point, you are probably curious how to calculate Adjusted EBITDA. The following is a simplified example of how you might begin calculating this formula for your business. Start with EBITDA; then add back value to your company by considering areas of excess and factoring in one-time costs.

Differences between EBITDA versus Adjusted EBITDA

EBITDA and Adjusted EBITDA have a few key differences. EBITDA, or Earnings Before Interest, Taxes, Depreciation and Amortization, identifies a company’s financial profits by calculating the Revenue minus Expenses (excluding interest, tax, depreciation and amortization). It compares profitability while excluding the impact of many financial and accounting decisions. The EBITDA margin is an assessment of a company’s operating profitability as a percentage of its total revenue. Calculating the EBITDA margin allows analysts and investors to compare companies of different sizes in different industries because it formulates operating profit as a percentage of revenue.

Adjusted EBITDA, on the other hand, indicates “top line” earnings before deducting interest, tax, depreciation and amortization. It normalizes income, standardizes cash flow, and eliminates abnormalities often making it easier to compare multiple businesses. Examples of when you need to account adjustments while evaluating the value of a company for a buyer include:

- Redundant assets

- Owner’s salaries or bonuses

- A facility rental above or below fair market value

Download the Top 10 Destroyers of Value to maximize the value of your company. Don’t let the destroyers take money from you!

[box]Strategic CFO Lab Member Extra

Access your Cash Flow Tuneup Execution Plan in SCFO Lab. This tool enables you to quantify the cash unlocked in your company.

Click here to access your Execution Plan. Not a Lab Member?

Click here to learn more about SCFO Labs[/box]