See Also:

ROE (Return on Equity)

ROIC (Return on Invested Capital)

ROCE (Return on Capital Employed) Definition

ROCE stands for Return on Capital Employed; it is a financial ratio that determines a company’s profitability and the efficiency the capital is applied. A higher ROCE implies a more economical use of capital; the ROCE should be higher than the capital cost. If not, the company is less productive and inadequately building shareholder value.

ROCE Formula

Use the following formula to calculate ROCE:

ROCE = EBIT/Capital Employed.

EBIT = Earnings Before Interest and Tax

Capital Employed = Total Assets – Current Liabilities.

Calculating Return on Capital Employed is a useful means of comparing profits across companies based on the amount of capital. It is insufficient to look at the EBIT alone to determine which company is a better investment. You also have to look at the capital and calculate the ROCE. Many consider ROCE a more reliable formula than ROE for calculating a company’s future earnings because current liabilities and expenses.

Are you trying to maximize the value of your company? The first thing to do is to identify “destroyers” that can impact your company’s value. Click the button to download your free “Top 10 Destroyers of Value“.

Download The Top 10 Destroyers of Value

ROCE Example

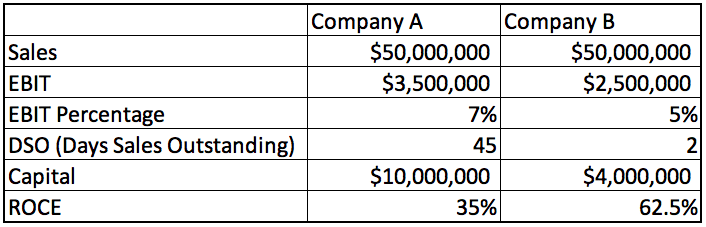

Look at the following table to see the importance ofReturn on Capital Employed (ROCE) in action.

Both Company A and Company B sell computers. Company A represents the Old Factory model; they are a distribution company that sells business to business. Company B is the New Factory; they are also a distribution company, but they sell on the Internet via credit card. Due to this modern convenience, Company B is able to receive payment within two days instead of the forty-five it takes Company A.

If you were to just consider EBIT, then Company A looks like the better investment at 7% return on sales compared to Company B’s 5%; however, with such a large DSO number, Company A is out $6,000,000 more than Company B at any given time. This means Company B needs less capital invested in the company which would result in a higher return on equity (ROE).

Thirty years ago, a similar scenario played out between IBM (Company A) and Dell (Company B). In his college dorm room, Michael Dell started taking credit card sales over the phone and was able to grow a billion dollar company with very little capital.

If you don’t leave any money on the table, then access our Top 10 Destroyers of Value to discover what areas of your business need to be attended to.

Access your Exit Strategy Execution Plan in SCFO Lab. The step-by-step plan to get more value when you exit your company.

Click here to learn more about SCFO Labs

(Originally published by James Wilkinson on June 9, 2016)