What is the impact of reducing your cash conversion cycle? Is it worth the effort? In order to quantify the benefit of reducing your cash conversion cycle, it’s important to understand exactly what it is.

Definition of Cash Conversion Cycle

Cash Conversion Cycle is a metric that expresses the length of time, in days, that it takes for a company to convert resource inputs into cash flows (also known as the cash cycle or operating cycle)

Formula of Cash Conversion Cycle

Cash Conversion Cycle (CCC) = Days Inventory Outstanding (DIO) + Days Sales Outstanding (DSO) – Days Payable Outstanding (DPO)

– or –

CCC = DIO + DSO – DPO

Put simply, it measures how quickly an unfinished product can be turned into cash.

Why Reduce Your CCC?

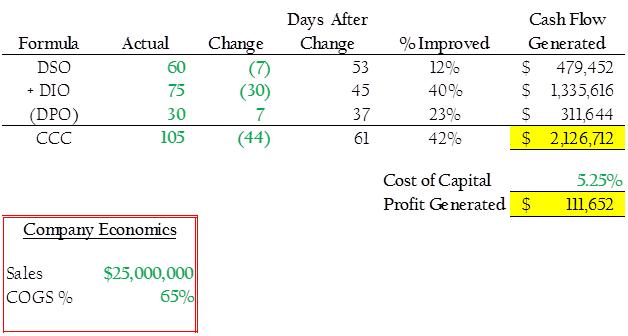

Now that we understand the components of the CCC, let’s look at what kind of impact changes in each component can have. Consider the following example:

In this example, a company with $25 million in sales volume (with gross margin of 35%) could free up over $2 million in cash by collecting receivables one week sooner, turning inventory once more per year and stretching payables by one week. At a cost of capital of 5.25%, it would also see an additional savings of over $100K in interest fall straight to the bottom line.

Plug in the variables for your business and see what kind of improvement in the cash conversion cycle you could expect by tightening up your collections, inventory or payables processes. The results may surprise you.

Who Should be Looking at This?

Certainly anyone in the organization with access to the data can do the calculation, but the CFO is responsible for making things happen. To be able to do this, the CFO has to be plugged into what’s going on in operations as well as finance in order to identify areas of improvement. This is one of the many ways a CFO can do more than simply crunch the numbers by providing strategic opportunities for growth through savings.

What could your company do with an extra $2 million in liquidity and $100K in profits?

[hr]

Learn how to apply concepts like this in your career with CFO Coaching. [button link=”https://strategiccfo.com/services/coaching/” bg_color=”#D76B23″]Learn More[/button]

For more ways to add value to your company, download your free A/R Checklist to see how simple changes in your A/R process can free up a significant amount of cash.

[box]Strategic CFO Lab Member Extra

Access your Projections Execution Plan in SCFO Lab. The step-by-step plan to get ahead of your cash flow.

Click here to access your Execution Plan. Not a Lab Member?

Click here to learn more about SCFO Labs[/box]

See Also:

Continuous Accounting: The New Age of Accounting