At Strategic CFO® we hear this all the time from entrepreneurs:

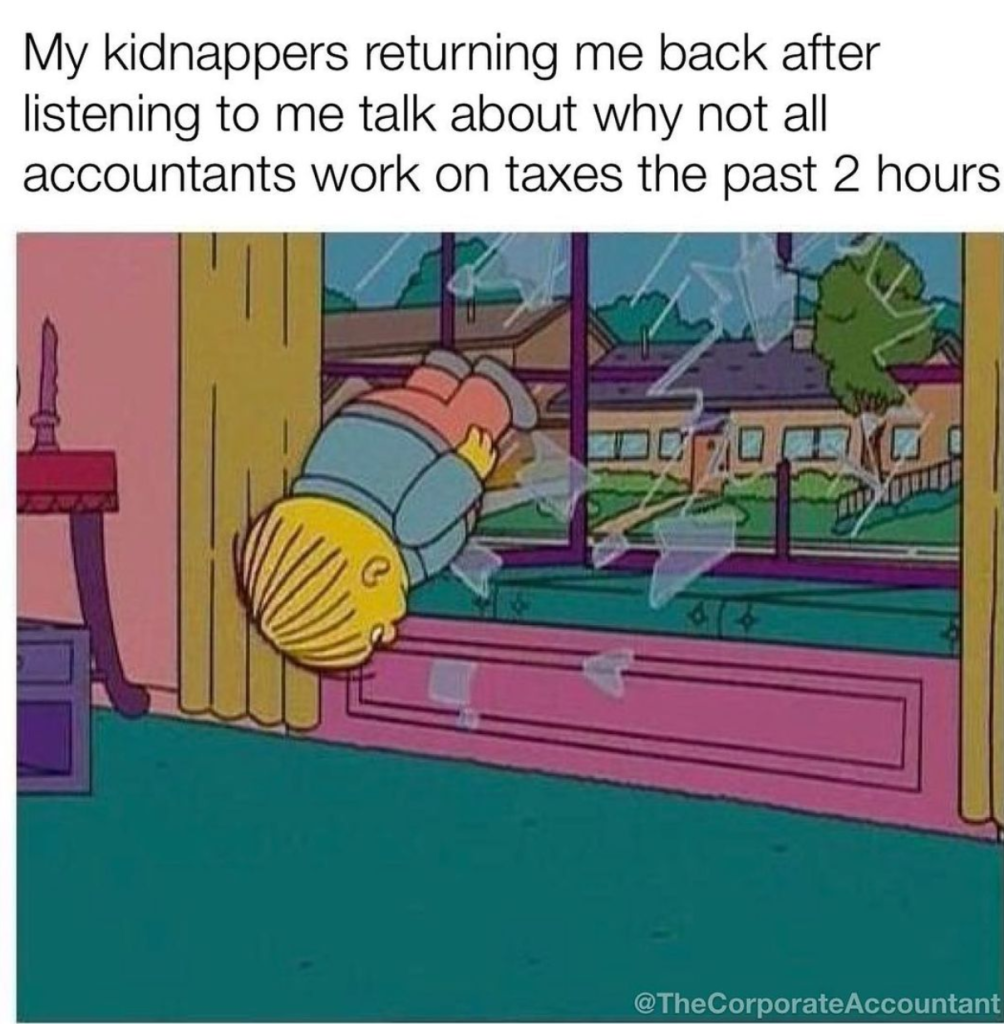

“My CPA handles everything.”

That assumption works when you are running a small business. A tax CPA, a bookkeeper, and basic accounting systems/softwares can cover the basics. But once your revenue pushes past five million, that setup is not enough to support growth.

One of the most common reasons companies hit growth bottlenecks is weak infrastructure, especially in finance and accounting. The reality is that accounting is not just about filing tax returns. It is the backbone of financial decision making, investor credibility, and ultimately, enterprise value.

Why CPAs and Bookkeepers Alone Cannot Support Mid-Market Growth

A CPA who prepares your tax filings plays an important role. Without them, compliance risks and penalties can derail your business. But ask yourself this:

- Does your CPA create rolling cash flow forecasts?

- Do they model out the financial impact of growth initiatives?

- Can they prepare GAAP financials that stand up to investor scrutiny?

Most of the time, the answer is no. And that is the problem.

As Forbes points out, many businesses fail because of poor financial management, not because the product or service is bad. When entrepreneurs rely only on tax accountants, they neglect the financial strategy and reporting required to scale.

The Accounting Roles Growing Businesses Actually Need

As your business grows, accounting expands far beyond taxes and bookkeeping. Different roles support different needs:

- Financial accountants ensure your statements are accurate and compliant with GAAP.

- Managerial accountants provide forecasts and budgets that guide decision making.

- Cost accountants help identify where margins are strong or eroding.

- Auditors and assurance professionals validate financials for lenders and investors.

You may not need all of these functions from day one, but once you cross into mid-market territory, gaps become obvious. Banks want to see credible statements. Investors ask for detailed forecasts. Buyers expect diligence-ready books. If your accounting team is only built for tax filings, you will face delays and credibility issues at exactly the wrong time.

The Hidden Bottleneck: Waiting Too Long to Scale Your Accounting Function

Many entrepreneurs wait until they need outside capital, a line of credit, or a buyer before they build a proper accounting function. By then, it is too late. Cleaning up years of incomplete records or non-GAAP reporting can take months, sometimes longer.

That delay can mean:

- Lost opportunities with investors or lenders

- Lower valuations during a sale

- Missed growth windows due to lack of financial clarity

As Harvard Business Review notes, companies that scale successfully build strong systems early. Finance and accounting are not exceptions.

Outsource Accounting vs. In-House: What Makes the Most Sense at or above $5M+ Revenue

The challenge for many businesses is that they cannot afford a full in-house accounting department. Controllers, auditors, tax specialists, and CFOs come with significant salary and benefit costs. For a five to twenty million dollar company, building that team internally often feels out of reach.

This is why outsourcing some or all of the accounting function can be a smart move. Consulting firms provide access to deep expertise at a fraction of the cost of a full-time team. Outsourcing also allows a business to scale financial capabilities as it grows.

Of course, outsourcing is not without frustrations. Entrepreneurs often worry about time zone gaps, language differences, or the loss of control and oversight when critical financial work is pushed offshore. Those concerns are real, and they stop many business owners from making the move.

NearSourcing™ Accounting Solutions: A Smarter Way to Scale Without Losing Control

Solutions like NearSourcing™ bridge the gap. Instead of sending your accounting halfway around the world, NearSourcing™ provides a team that works in closer time zones, offers stronger oversight, and integrates directly with your leadership team. This allows entrepreneurs to access the accounting resources they need long before they could typically afford to build them in house.

NearSourcing™ combines the affordability and scalability of outsourcing with the accountability and visibility of an internal team. For growing companies, it is often the best of both worlds.

Takeaway

Accounting is not just for taxes. If your business has grown beyond five million in revenue, a CPA, a bookkeeper, and basic or starter systems are not enough. The question is not if you will need a more sophisticated accounting function, but when. Outsourcing through solutions like NearSourcing™ ensures you get the right financial infrastructure at the right time, without overextending your payroll.

At Strategic CFO® we help companies build and scale their accounting functions with flexible models that balance affordability and expertise. Contact us today to explore how NearSourcing™ can support your next stage of growth.