90-Day Sprint – Get a Handle on Cash

Step 3: Prepare Cash Flow Projections (Weeks 5-6)

Upon entering a new organization, you’ve evaluated the current landscape, addressed critical issues, and modernized the accounting system. With financial records now in order, it’s time to focus on cash flow—the essential lifeblood of any business.

The Importance of Projections

Before analyzing historical data, projecting future cash flow is imperative. Cash flow projections provide invaluable insights, enabling you to anticipate challenges, seize opportunities, and maintain financial stability.

To establish clarity around key terms:

To establish clarity around key terms:

- Budget: Where you plan to go.

- Forecast: Where you expect to go.

- Projection: Where you might go.

At Strategic CFO, we emphasize projections as they serve as dynamic tools to guide the business towards profitability. Projections act as a strategic guide-wire, enabling course corrections mid-year to ensure financial accuracy and alignment with year-end goals.

Why Create Projections?

Projections provide essential benefits:

- Anticipate challenges and opportunities over 3, 6, or 12 months.

- Stress-test the organization’s resilience against potential crises.

- Chart a clear roadmap for achieving profitability and cash flow stability.

Key Financial Projections to Include

Leading financial professionals recommend incorporating:

- Projected Income Statement – A cornerstone for 90% of high-performing finance teams.

- Projected Cash Flow Statement – Used by 60% of top professionals for liquidity planning.

- Projected Balance Sheet – Leveraged by 10-15% of top performers to maintain a comprehensive financial perspective.

Combining these statements with compliance ratios tailored for banking requirements sets your financial strategy apart from the competition.

Cash Flow Methods and Reports

There are two primary methods for cash flow analysis:

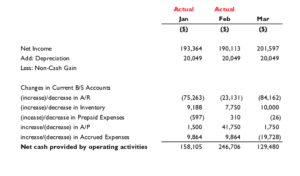

- Indirect Method: Our preferred approach due to its practicality and alignment with standard accounting practices.

- Direct Method: A straightforward calculation of cash receipts minus disbursements, offering conceptual simplicity.

In addition to projections, consider these insightful reports:

- Flash Report: Weekly updates on key performance indicators (KPIs) and liquidity trends for the next 8–12 weeks.

- Daily Cash Report: Real-time visibility into your cash position, enhancing decision-making on immediate needs.

- 13-Week Cash Flow Report: A critical tool for navigating liquidity challenges and ensuring financial stability.

Refining Projections with Real-Time Data

As new data becomes available, integrate actuals into your projections. This iterative approach ensures your financial outlook remains accurate and actionable, refining your roadmap for the next 3–6 months.

By leveraging these tools and strategies, you can confidently steer your organization towards sustained success and financial resilience.

Resources:

Financial Statement Cheatsheet