A/R Optimizer » Results & Measurement

DSO Cash Cruncher Template

The purpose of calculating DSO and savings that are generated in this process is to determine how the improvements have affected the company. The growth of a company depends on trial and error; finding which methods work and which do not. Calculations such as this are the best reflection of those improvements.

This tool will compare the current DSO to the days improved with the new policies. Then calculate those values to find the amount of profit generated and the value the improvements have added.

Calculating DSO

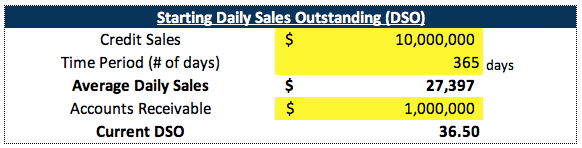

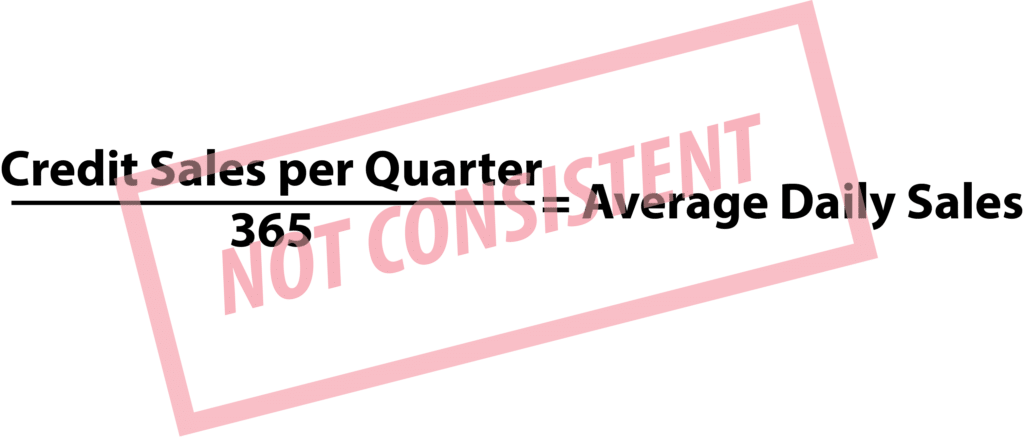

Calculating your current daily sales outstanding is a multi-step process. First, determine your credit sales within a certain time period (months, years). It might be more accurate to calculate a few months or a quarter rather than a full year, because certain parts of the year may have better sales than others. Make sure you stay consistent with your number of days and credit sales to calculate your numbers correctly. After you input that data, insert the number of days used to determine your credit sales. Calculate your average daily sales by dividing credit sales/time period.

After you input that data, insert the number of days used to determine your credit sales. Calculate your average daily sales by dividing credit sales/time period.

Then, divide your remaining accounts receivable within that time period by the average daily sales. This will result in your current DSO.

Then, divide your remaining accounts receivable within that time period by the average daily sales. This will result in your current DSO.

Calculating # Days Improved

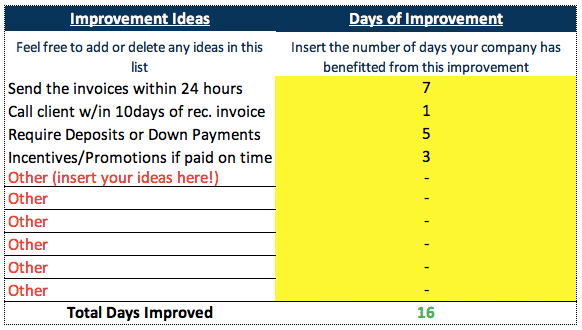

With the ideas brainstormed from the previous lessons, input your own ideas into the column and then type of the number of days the idea has impacted your accounts receivable. This value should be the number of days improved that your accounts receivable are converted to cash received due to the implementation of a new idea.

With the ideas brainstormed from the previous lessons, input your own ideas into the column and then type of the number of days the idea has impacted your accounts receivable. This value should be the number of days improved that your accounts receivable are converted to cash received due to the implementation of a new idea.

The tool should add up your total days improved. We will use this value for the next step.

Calculating Profits Generated

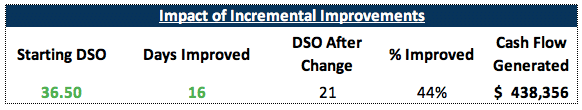

Now that you’ve calculated your original/current DSO, and the days improved from the policy changes, you can determine the amount of profit you’ve generated. The difference between the original DSO and the days that were lessened equal the new DSO. If you multiply the percent improved by the accounts receivable, you will have the total cash flow generated.

Now that you’ve calculated your original/current DSO, and the days improved from the policy changes, you can determine the amount of profit you’ve generated. The difference between the original DSO and the days that were lessened equal the new DSO. If you multiply the percent improved by the accounts receivable, you will have the total cash flow generated.

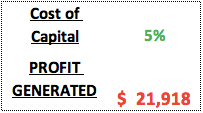

Finally, multiply the total cash flow generated and your cost of capital (what interest rate your bank would charge). The tool will do the calculations for you, but for further explanation, this is how much profit you would realize by generating cash internally rather than borrowing it.

Finally, multiply the total cash flow generated and your cost of capital (what interest rate your bank would charge). The tool will do the calculations for you, but for further explanation, this is how much profit you would realize by generating cash internally rather than borrowing it.