Strategic Pricing Model » Know Your Economics

Purpose Of Knowing Your Economics

Often, the income statement is organized to produce GAAP financial statements versus providing management an overview of the profit creation process. By organizing the income statement in a strategic way, you can obtain measurements of your KPIs on a monthly basis.

The purpose of knowing your unit economics for a particular product or service is to determine whether it is profitable or not. Knowing the costs associated with this particular product will allow you to strategically price your product to return a desirable profit. Once you find that perfect price point, you will be able to scale from one unit to X amount of units.

Ram Charan, from “What The CEO Wants You To Know, “saw that regardless of the size or type of business, “A good CFO should bring the most complex business to the fundamentals”, that being unit economics. Charan continues to claim that “most successful business leaders should never lose sight of the basics.”

Knowing your economics (your business’s basic fundamentals) will illustrate where you can become more profitable.

Strategic Pricing Model Funnel

Similar to a typical sales funnel, we have the Strategic Pricing Model Funnel or Cash Flow Funnel.

If you’re new to the company or you believe that your company’s unit economics aren’t what you think they should be, then talk.

Talk to the people in your company to find our what costs are associated with a product. This includes managers, manufacturers, shippers, custodians… Everyone. As a financial leader (CFO, financial consultant, controller, comptroller, accountant, etc.), it is imperative for you to leave your office to widen your perspective of what’s going on beyond the financial spreadsheets in front of your face. By talking to people, you’ll be better able to understand the scope of your unit economics.

There are several layers between your revenue and your profit. If your price is greater than your costs, then you should see a profit. However, many clients forget to calculate all of the expenses; utilities, payroll, insurance, etc..

Accountants or financial leaders with an accounting background tend to look to GAAP for all their needs in running the books. But as a financial leader, your responsibility is to increase the profit margin by managing the cash flow and reducing the overhead.

There are three components in setting a strategic price:

- Know your economics

- Build your pricing model

- Produce financial statements

Use your current pricing model in this funnel to prove its profitability. Remember, it is important for you to focus on the same things throughout this model!

Know Your Economics

Knowing your economics should be the first thing you learn when you start at a company. If you don’t know how you’re going to make money as a business, then doesn’t it seem silly for you to be working? Once you have a handle on how you make a positive net income, you’ll be able to improve profitability.

Build Your Pricing Model

Structure a price that will be greater than your unit costs. If you’re looking for a certain margin, then this is where you’d want to factor it in. If you aren’t sure what the average margin your industry maintains, then there are many resources to reference to, such as RMA or other online sources.

Produce Financial Statements

One of the biggest uses for financial statements is to confirm your economics. Do your current economics provide a margin that is satisfactory or do they result in a negative net income?

One of the biggest uses for financial statements is to confirm your economics. Do your current economics provide a margin that is satisfactory or do they result in a negative net income?

If your company isn’t content with the realized margins, then the first step is to start from the beginning. Restructure a price that will cover all possible expenses or costs of goods sold to return a positive net income. The key is to know your economics and at what price point can you make a profit.

Look at your current unit economics for any given product or service. Put it through the funnel again.

Unit Economics

Most of our clients do not know their economics, causing them to guess their prices without factoring all of the costs associated with those products or services. Because they fail to understand unit economics, they are missing out on potential profit (unless you get lucky). Let’s review unit economics:

Definition

Unit Economics or Economics of One Unit (EOU) are the direct costs and revenues associated with a product or service on a one unit basis. Direct costs could be facilities, labor, materials, freight, etc..

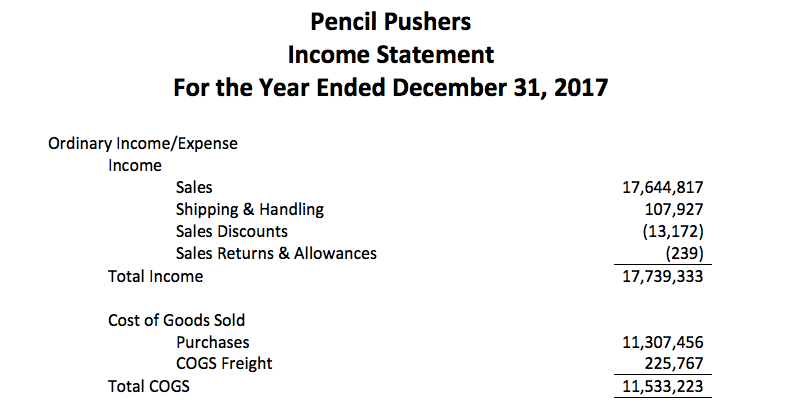

Example: Pencil Pushers

(Pencil Pushers, Year End Dec. 31, 2017)

About 74% of Pencil Pusher’s revenue is tied up in COGS… And all the detail for 74% of revenue is purchases and freight.

How many products does Pencil Pushers sell? What are the costs of each product sold? How can Pencil Pushers determine whether these financials are correct? Where does Pencil Pushers cut costs? Did Pencil Pusher’s price their products at a point where there is a profit? What products are more profitable than others?

See the problem? If your income statement looks like this, then you’re not alone.

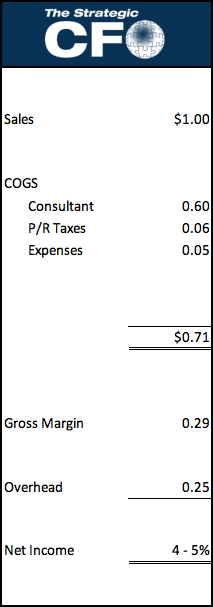

Let’s look at a product that sells for $1:

Product – Revenue $1

COGS 20%

Labor 10%

Overhead 30%

Commission 10%

Gross margin $0.30

This unspecific example gives you a return of 30%. However, many of our clients neglect to consider unit economics when they set their price allowing for a 30% gross profit margin when their overhead expenses are 40%. It’s key that you factor in every possible cost associated with selling this product to avoid mis-pricing your product or service. When you think you’ve factored in all costs, have you considered: marketing, accounting, labor, commission, bad debts, insurance, etc.? It all counts!

By overlooking details, you may find yourself not pricing your product or service at a point to result in a certain profit margin.

(More information about how to apply unit economics will be found in the “Build Your Model” Lesson.)

(Another Example)

Know Your Economics Template

Know Your Economics Template: Download Here