Dynamic Cash Flow Projections » Compliance Ratios

The Purpose Of The Compliance Ratios Section

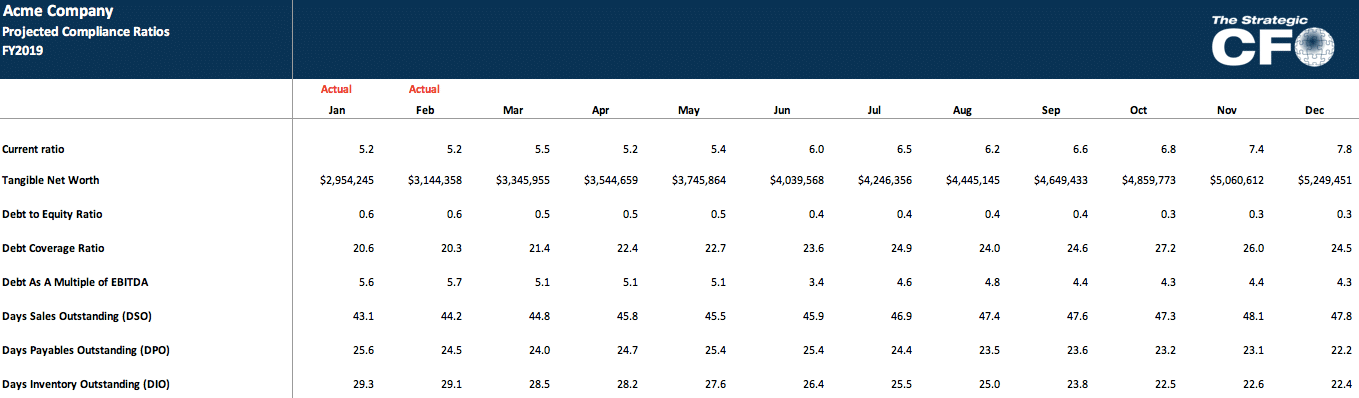

The purpose of the Compliance Ratios section is to determine if your company will be able to meet its compliance requirements under its debt agreements. This is based on the projected financial statements.

This is why it is imperative that your financial statement projections reflect reasonable expectations of your company’s performance for the fiscal year.

Know if it’s likely that your company will be out of compliance by the end of the year.

How To Develop The Compliance Ratios Section

The compliance ratio sheet will help you monitor your compliance with the terms of your company’s long-term debt agreements. Typically these are financial ratios. They can include the debt coverage ratio, long-term debt as a multiple of EBITDA, and DSO. Although, they can include other measures. In the recent past, the acceptable value for debt as a multiple of EBITDA was usually 4 times. But in the current environment, it’s likely 2 to 2.5 times. If your company is obtaining new financing in the near future and want to know what ratios lenders use, then see the R-Series Report.

You will want to monitor these compliance ratios on a monthly basis. The projected ratios are important. The actual values you drop in your actual monthly financial statement data are also important. Be sure to look at the actual values for the debt compliance ratios to see if there are any significant negative trends. These trends may lead your company to being out of compliance by the end of the fiscal year.