Cash Flow Tune-Up » Cash Conversion Cycle

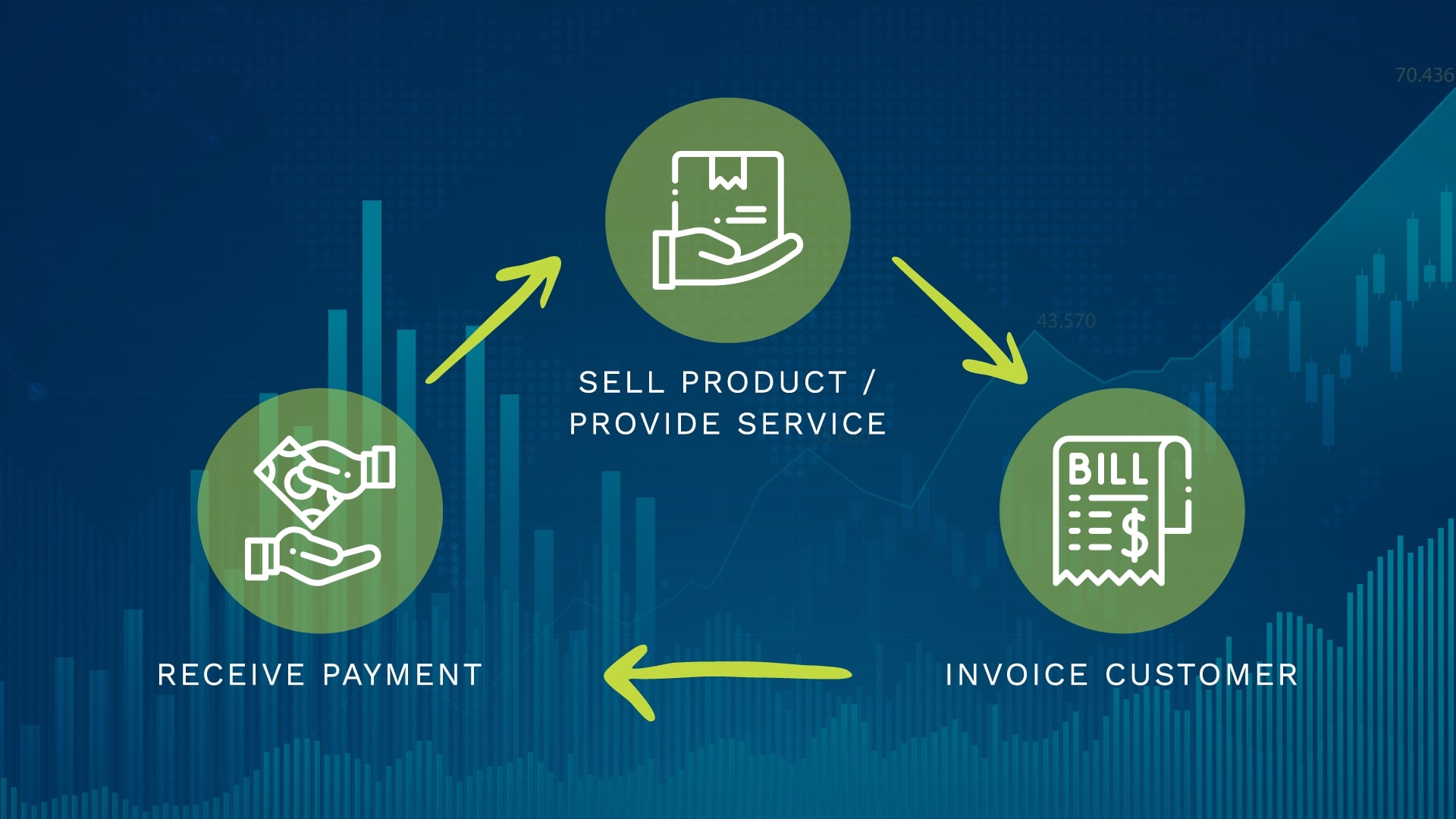

Purpose of the Cash Conversion Cycle

The Cash Conversion Cycle (CCC) reveals how effectively a company transforms its investments in resources into actual cash. It essentially measures the time it takes for a business to buy inventory, sell it, and collect the cash from the sale, while also considering how long it takes to pay its own suppliers.

Because industries differ significantly in their sales and payment patterns, the CCC provides valuable insights that help businesses fine-tune their strategies for optimal cash flow and operational efficiency.

The CCC Formula:

The CCC is calculated as follows:

CCC = DSO + DIO – DPO

Where:

- DSO (Days Sales Outstanding): The average number of days it takes to collect payments from customers after a sale.

- DIO (Days Inventory Outstanding): The average number of days inventory is held before it’s sold.

- DPO (Days Payables Outstanding): The average number of days a company takes to pay its suppliers.

Shrinking Your CCC: A Path to Better Cash Flow

A shorter CCC generally translates to improved cash flow and greater financial flexibility. Here’s how to shorten each component:

- Speeding Up Collections (Lowering DSO):

- Tighten Credit Policies: Implement robust credit checks, especially for large orders.

- Prioritize Payment: Segment customers and focus on those who pay reliably and quickly.

- Dedicated Collections: Assign a team member to proactively follow up on overdue invoices.

- Invoice Promptly & Clearly: Send out invoices immediately with clear and easy-to-understand terms.

- Offer Incentives: Provide discounts for early payments.

- Tie Commissions to Cash: Base sales commissions on cash received, not just invoiced amounts.

- Reducing Inventory Time (Lowering DIO):

- Real-Time Tracking: Use a perpetual inventory system for accurate stock monitoring.

- Analyze Sales Trends: Avoid overstocking by closely examining product performance.

- Optimize Warehouse Processes: Reward staff for improvements in inventory turnover.

- Just-In-Time (JIT) Inventory: Implement JIT practices to minimize excess stock.

- Extending Payment Terms (Increasing DPO):

- Cash Flow-Based Schedule: Plan vendor payments around projected cash inflows.

- Negotiate Longer Terms: Ask suppliers for extended payment deadlines.

- Use Early Payment Discounts Wisely: Take advantage of early payment discounts when cash is available.

- Consider Promissory Notes: Convert large balances into promissory notes to extend payment periods.

- Segment Suppliers: Differentiate between regular and one-time suppliers to tailor payment approaches.

More Strategies for Enhanced Cash Flow

Beyond the CCC, consider these tactics:

- Minimize Fixed Asset Purchases: Postpone non-essential capital expenditures when cash is tight. If unavoidable, align financing with the asset’s potential to generate revenue.

- Optimize Lease Agreements: Renegotiate lease terms to lower overhead expenses.

- Make Idle Cash Work: Use sweep accounts to earn interest on excess cash balances.

- Seek Additional Capital When Needed: Explore investment opportunities or lines of credit to fuel growth initiatives.

By strategically managing your cash conversion cycle and implementing these additional techniques, your business can free up capital, enhance financial stability, and pave the way for sustainable growth.

[gravityform id=”40″ title=”true” description=”true”]