Action Plan » Overview

An Action Plan is a structured document outlining the tasks and projects that a Controller or CFO is accountable for within a company. It serves as a vital communication tool between financial leadership and ownership/management, ensuring everyone is aligned on priorities, progress updates, and resource allocation.

Purpose of the Action Plan:

- Communication with Leadership: Keeps ownership and management informed about ongoing financial activities, helping to manage expectations and prioritize effectively in a dynamic environment.

- Managing Leadership’s Expectations: Provides stability and accountability, particularly beneficial when working with fast-paced, priority-shifting entrepreneurs. The Action Plan demonstrates completed projects and ongoing commitments, fostering a clear understanding of financial progress.

- Staff & Team Management: Streamlines task delegation and holds team members accountable for their assigned responsibilities and deadlines.

- Self-Management & Prioritization: Facilitates focus on high-impact tasks, ensuring the efficient and timely achievement of critical financial goals and objectives.

How to Use the Action Plan Effectively:

- Document & Communicate Scope of Work: Clearly outline all financial projects and priorities, providing transparency regarding workload and expectations.

- Manage Expectations & Workload: Prevents overextension by ensuring a realistic view of what can be accomplished given existing time and budget constraints. It also enables negotiation of reasonable deadlines and appropriate resource allocation.

- Track and Showcase Accomplishments: Maintains a record of completed projects, serving as a powerful tool for performance evaluation and highlighting contributions to the company’s growth.

In conclusion, utilizing an Action Plan empowers financial leaders to enhance efficiency, maintain focus, drive informed decision-making, and ensure alignment with overall company objectives.

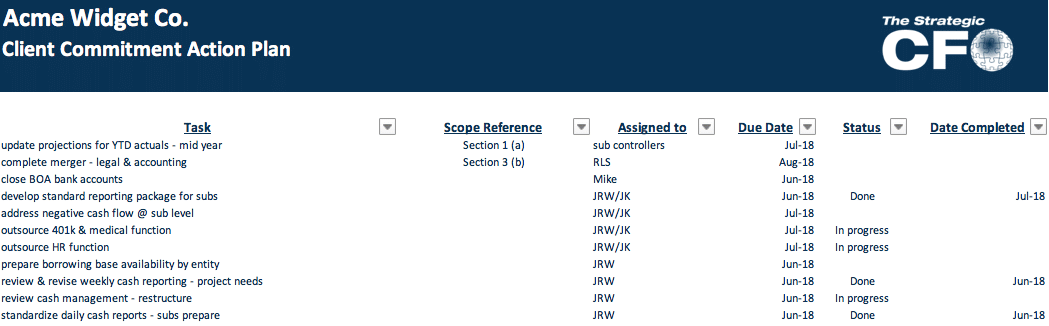

Action Plan Template

Click to download: Action Plan Template