Strategic Pricing Model » Organizing Your Financial Statements

The Purpose Of Organizing Financial Statements

The Importance of Organized Financial Statements

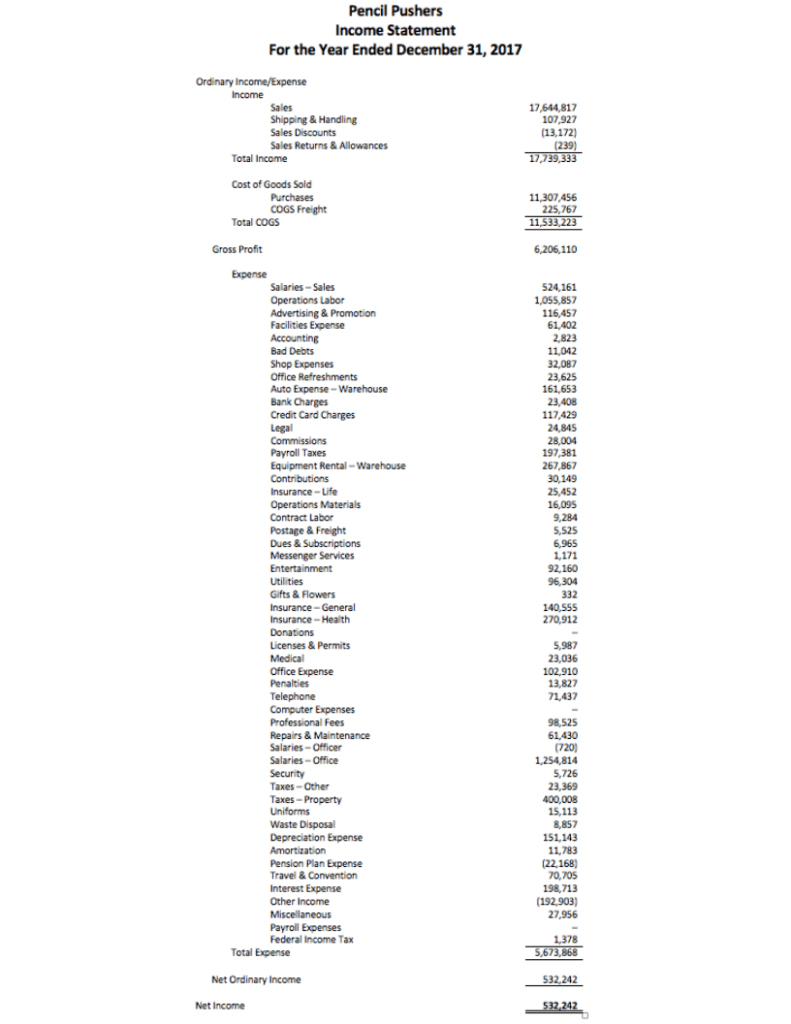

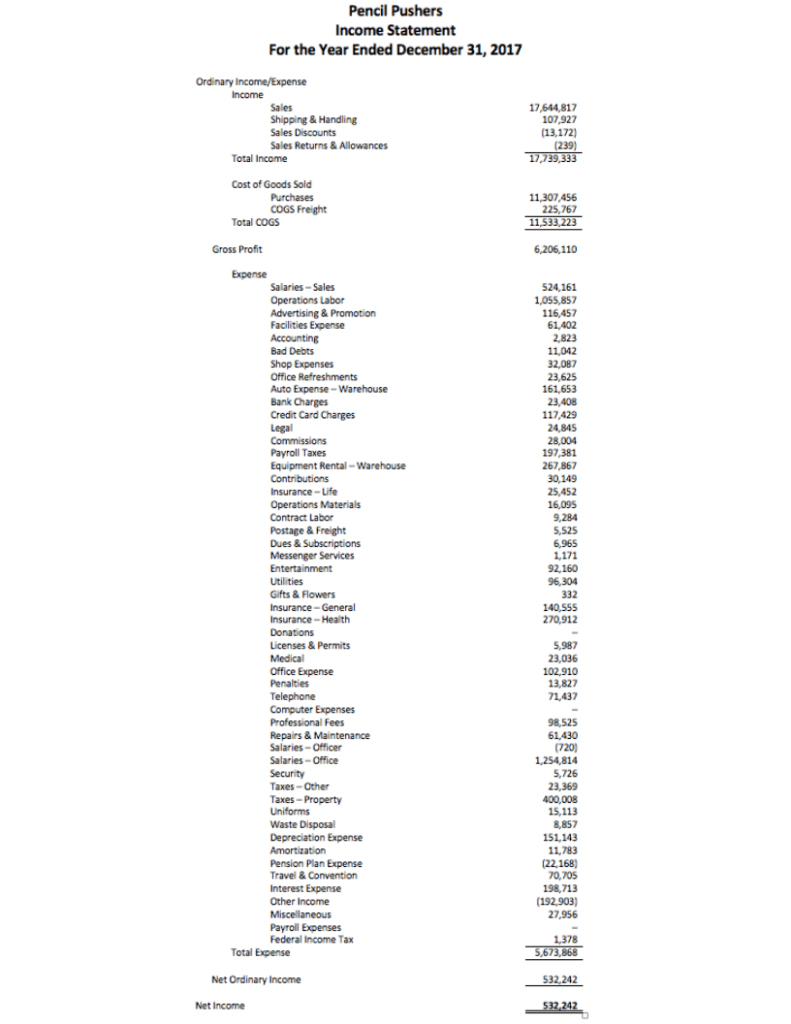

Many businesses undermine their pricing strategies and profitability by failing to organize their financial statements effectively. Often, they focus on minute overhead details while neglecting a strategic analysis of revenue and the cost of sales.

Evaluating Your Financial Statement Effectiveness

Examine your income statement and consider:

- How many line items do you have for revenue?

- How many line items do you have for the cost of sales?

- How many line items do you have for SG&A (Selling, General & Administrative) expenses?

- Are there excessively detailed expense accounts within SG&A?

An imbalance, where COGS and revenue are overly generalized while SG&A is meticulously detailed, indicates a lack of clarity regarding product or service-level profitability.

Optimizing Financial Statements for Strategic Pricing

To align pricing strategies with real-world profitability, structure your financial statements to mirror unit economics.

- Enhance Revenue & Cost of Sales Detail:

- Classify revenue by product, service type, or geographical region.

- Directly link COGS items to their corresponding revenue sources.

- Simplify Overhead Accounts:

- Avoid over-analyzing minor overhead expenses.

- Reassign relevant overhead costs to COGS when appropriate.

- Align Financial Statement Format with Pricing Models:

- Organize expenses to reflect the structure of your gross margin calculations.

- Monitor and compare actual vs. target gross margins monthly.

Analyzing & Reducing Expenses

- Prioritize the most significant expenses.

- Use Flux Analysis to compare month-to-month variations.

- Identify cost trends related to sales volume.

- Seek out easily achievable cost reductions.

If your financial statements don’t align with your pricing strategy, you lack the critical insights needed to maximize profitability. By strategically organizing your financials, you enable informed decision-making and pave the way for lasting financial success.