Exit Strategy » Destroyers of Value

If you are thinking about selling and are already in the due diligence process, you will often find that there are “destroyers” in your business.  Let’s take a look at some of those destroyers and how to address them now…

Let’s take a look at some of those destroyers and how to address them now…

#1 Distinguishing Yourself from Your Business

Creating a Self-Sustaining Asset

It is essential to detach your personal identity from your company’s operations when assessing its value. Ideally, a business should be capable of generating revenue without requiring your constant involvement. If your enterprise is dependent on your leadership for operation, its marketability and potential sale price will suffer significantly.

Evolving from Job to Business

According to Michael Gerber’s E-Myth, if you find it challenging to separate yourself from the day-to-day operations, you have merely built a job instead of a business. To increase long-term value, business owners should cultivate robust leadership teams, standardize processes, and create a brand that exists independently from their personal identity.

#2 Inconsistent Revenue Streams

Risks Associated with Irregular Income

Many entrepreneurs depend on occasional high-value sales or one-off transactions, leading to unpredictable revenue patterns. This volatility complicates financial planning and diminishes the company’s appeal to potential buyers.

Developing Sustainable Revenue Models

To lessen this risk, it is advisable to establish recurring revenue streams through subscription services, long-term contracts, or membership programs. This approach ensures a reliable cash flow, bolsters financial stability, and boosts overall business valuation.

#3 Heavy Dependence on a Limited Customer Portfolio

The Threat of Customer Concentration

Companies that derive most of their income from a small group of clients are particularly exposed to risks stemming from external factors. Changes in client leadership, economic downturns, or financial issues within a client can significantly impact revenue.

Strategies for Diversification

Let’s say these customers are loyal to you. Well, you still have a problem. The majority of your revenue is tied up in a handful of people, and what happens if they go bankrupt? What if they change leadership, and the replacements go in a different direction? What if the marketplace becomes more competitive or technological advancements threaten the industry? Well-positioned business owners account for these changes by diversifying and expanding their customer base; they cast a wider net mitigating their risk, making their business more stable, as well as more valuable to a seller.

Ways To Broaden Your Customer Base:

- Put resources into acquiring new customers and expanding your hold on the market.

- Build a “Cash Cushion” so that you’re not dependent on those few big fish while you’re finding the smaller ones. If they leave you, you won’t be hemorrhaging on the side of the road.

- Make switching providers more difficult with Long Term Supply Contracts or Preferred Vendor Agreements.

- Make sure all your employees have signed non-compete clauses with strict penalties.

- Create an immediate back-up plan. What would you cut if you lose a critical client or customer?

- Dependence on Key Employees without Non-Compete Agreements

#4 Reliance on Key Employees Lacking Non-Compete Agreements

Disclaimer: Non-compete Agreements must adhere to state and national employment regulations, and a labor law attorney should be consulted to verify conditions. You should consider Non-compete Agreements for employees, clients, shareholders, suppliers, and partners. Oftentimes, the buyer will require the seller to sign one as well.

Protecting Intellectual Property

Protecting Intellectual Property

Critical employees, especially in sales and management, hold valuable relationships with clients and possess essential institutional knowledge. Without enforceable non-compete agreements, they could leave and take important clients with them, thereby harming the company’s value.

Implementing Legal Safeguards

If you have a consulting firm, it is problematic when clients hire consultants out from under you. If a client pays $150/hr for Cathy the Consultant, and she works 20 hours a week, 50 weeks out of the year, Cathy will cost the client $150,000 for 1,000 hours of work. You, as the owner of the consulting firm, are getting a 40% cut of the $150/hr for supplying Cathy, so this benefits you. You are filling a client’s need, which benefits him, and providing business to Cathy, which benefits her.

But now Cathy and the client have made the connection, and they don’t need you. If the client wants to cut you out of the equation and hire Cathy full-time, this benefits the client and Cathy but damages your business. If the client offers Cathy a $200,000 salary, Cathy is happy because she has consistent work with one client and does not have to worry about any gaps in employment hours. The client is happy because he now has a full-time, salaried employee working roughly 50 hrs a week, 50 weeks out of the year. So, now, instead of Cathy costing $150/hr, she costs him $80/hr ($200,000 salary/2,500 hrs of work=$80/hr).

You, however, have lost an income stream; plus, you have to find, hire, and train a new employee, costing even more money. If this pattern continues, and employees keep leaving with clients, you no longer have a consulting firm.

Non-compete Agreements are time and geographically limited; they prohibit key people, for typically a period of one to two years, from taking trade secrets to a direct competitor or business from existing customers.

#5 Ineffective Record-Keeping

Consequences for Business Valuation

On our Exit Strategy Checklist, you will see there are almost 200 items you need to prepare for a business valuation. Most of these are documents and financial statements that will be assessed by your team, the potential buyer’s team, and probably a third-party assessor. If you do not maintain meticulous records, the buyer or assessor will not be able to determine an accurate valuation of your business. We have been told by two separate investment bankers that the difference in value for a company having clean accounting records vs. messy accounting records can be as much as a multiple of 1 x EBITDA in valuation.

Several years ago, we were hired to position a company for sale. The owner complained that he couldn’t understand his financial statements. One month he’d have profit, the next month loss.

Step 1: Clean up Financial Records

After cleaning up this client’s financial records, we discovered hidden profits we were able to unlock with accurate records, consequently increasing the value of his company.

When you do not maintain good records, you do not maximize profits and cash flow and, as a result, do not maximize the value of your company. Get good records and you’ll probably find additional profits.

Step 2: Establish Credibility

If you, as the seller, have good records, then I, as the buyer, have more confidence in the verbal representations that you give me. Maintaining good records lends credibility to your entire package. If you’re sloppy with records, you may be sloppy with facts you give me. Give me reason to trust you and not discount your company off the bat.

Step 3: Reduce Risk to Increase Price

A buyer will pay more for a company with reduced risk. The higher the transparency, the better the information, or at least the better the information will be perceived and considered by the buyer. Clearer information means a lower risk to the purchaser which will lead to a higher price for your business!

Not maintaining good records decreases value! Don’t let this happen to you.

#6 Limited Financial Literacy and Performance Metrics

The Purpose of Ratios

Ratios are important; they determine value. As a business owner, they help you understand patterns, function, and the relationship of a part of your company to its overall success. As an assessor responsible for business valuation, it is vital to understand and calculate the right financial ratios for any situation. These ratios can evaluate a company’s financial stability, productivity, profitability, return on investment, or employee performance.

Ratio Analysis helps you analyze financial statements, identify trends, recognize areas of growth or weakness; they help you measure the overall state of your finances and value of your company. They are also used by outside valuators and potential buyers of your business to compare your performance to others in the industry. Consequently, it is critical to use the correct ratios and to understand their significance.

Even if you are not planning to sell immediately, it is important for you to begin calculating these figures to determine your company’s performance and value.

For more information on understanding your ratios, check out our R-Series tool.

#7 Prioritizing Tax Reduction Over Business Value

Make Your Business More Valuable

Understandably, business owners want to pay as few taxes as possible in order to keep as much cash on hand. However, skirting the system and flirting with below-the-line deductions will make your business look less valuable to a seller as it suggests a lower income than probably exists. It can also hurt your credibility as these actions can be interpreted as being “dishonest” with your taxes.

Don’t Minimize Value By Minimizing Taxes

There are plenty of expenses and deductions that are worthwhile and necessary such as supplies, raw materials, travel, entertaining clients, half the cost of meals, laptops, vehicles for work, etc. However, when owners try to put family members on payroll, deduct personal expenses and purchases, or move money around to make it look like they’ve given more to charitable donations than they have, they inadvertently decrease the value of their business. By minimizing profits to minimize taxes, they end up minimizing the value of their company.

How to get more value for your buck

Let’s say you have equipment that is good for 6 years, but you decide to buy new equipment after 5 years in order to minimize taxes. You are choosing to minimize taxes rather than maximize reported profits. You are thinking short-term—you want cash to grow your business, but it can cost you considerable money in the long run.

Think of it this way, a buyer cares about income and profit, and an assessor is going to place a value on your business. If you take too many tax deductions, it looks like you don’t have enough valid income. Consequently, your business will not be valued as much in a sale.

Look at the Following Table

| Scenario | Taxable Income | Business Valuation | Purchase Price |

| Scenario A | $500,000 | 4X Net Cash Flow (4X $500,000) | = $2,000,000 |

| Scenario B | $425,000 | 4X Net Cash Flow (4X $425,000) | = $1,700,000 |

In Scenario A, the owner has demonstrated taxable income of $500,000. If his company receives a multiple of earnings valuation of 4x, his company would be worth $2,000,000.

In Scenario A, the owner has demonstrated taxable income of $500,000. If his company receives a multiple of earnings valuation of 4x, his company would be worth $2,000,000.

In Scenario B, the owner has run excessive personal deductions and expenses to minimize taxes, showing a taxable income of $425,000. That $75,000 reduction in profit will cost him $300,000 in the sale of his business.

#8 Mismatch with Buyer Expectations

Sellers vs. Buyers

Entrepreneurs are meticulous planners, who have carved out a piece of the industry for them by building a company with measured, researched steps. They must know the market. In addition, they must anticipate the needs of their customer. They must also be innovative and flexible, responding to changes in the marketplace, technological advances, and future competitors.

An outsider, or potential buyer, might view some of the seller’s decisions as exceptionally risky; however, they do not have the direct experience and market knowledge of the owner.

The Differing Perspectives of a Seller and Buyer

Risk is relative. An insider’s perspective and an outsider’s perspective inherently vary — one’s on the inside, with confidence, information, and experience while the other is out, navigating a potentially foreign world. The insider and outsider have different goals; the outside investor’s primary focus is to not lose capital. They are worried about the motivations of the seller, the changing market, and the unknowns.

Value Is Determined Through The Eyes Of The Buyer

When approaching business valuation, the seller must assess their company from an outsider’s point of view. They must remove emotional attachments and consider the investment as objectively as possible. The seller must understand that his perception of risk will be magnified in the eyes of the buyer. Once the risks are understood and safeguarded, investors and protectors will give greater consideration and higher valuation to the potential business acquisition. When we approach a business owner contemplating to sell their business, we ask in the first meeting what price the seller has in mind. 9 times out of 10, the owner/seller has an overvalued number he is thinking of. It usually takes a couple more meetings before we talk about reality.

By having as many completed items from the Exit Strategy Checklist, you reduce risk to outside investor and improve the valuation of your company.

#9 Inefficient Use of Capital

Don’t Leave Value On The Table

Small business owners are often wary of using credit or taking on debt; however, in most cases, they are leaving opportunities and returns on the table. All good things in moderation and this includes debt. With low interest rates, it is easy to obtain loans at a competitive rate, which would provide the quick capital you need to grow your business.

Overcapitalization Is Bad

Company A has no debt and tons of cash, which the owners see as good. In reality, they are overcapitalized. A buyer wants to leave just as much liquidity as necessary for the company to operate. As the seller, you should do the same. Optimize your use of capital to make sure you’re not overcapitalizing your business.

Undercapitalization Is Also Bad

Company B is not efficiently utilizing their assets because they are cash constrained. When you’re undercapitalized, you can’t invest in new equipment, processes, or talent. You don’t have the money to invest in the company. Use some debt, minimize cash conversion cycle, and retain some equity to adequately fund the needs of your company in order to become as profitable and valuable as possible.

Some Other Benefits to Taking on Debt or Using Credit:

- Establishes relationship with lender for down the road.

- Improves credit rating for your business.

- If retained earnings are not distributed, you have more liquidity than necessary. If you have too much capital, you may be too conservative. A buyer would strip out earnings, so you should reduce returned earnings before the buyer to improve your return on equity.

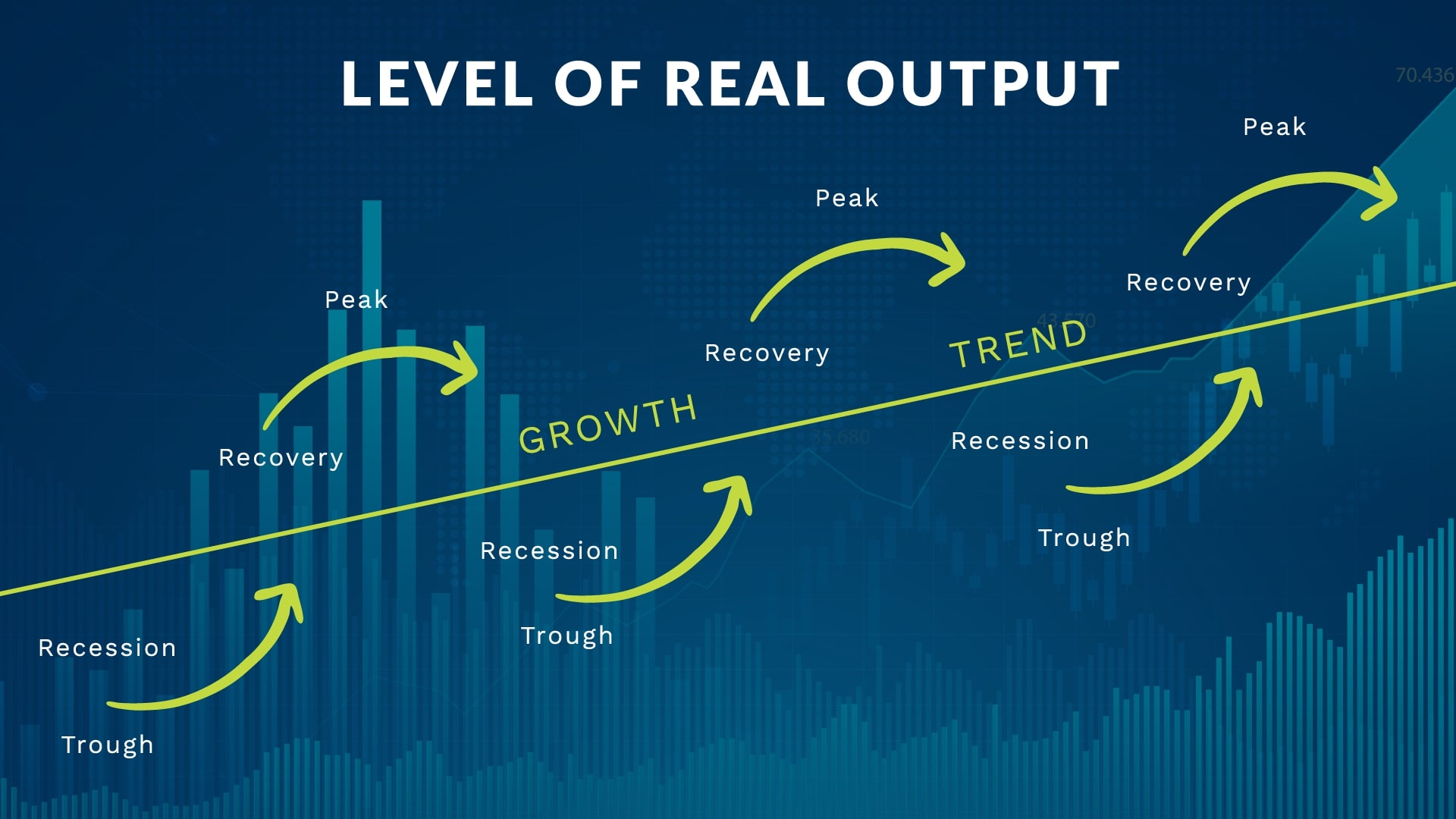

#10 Neglecting Economic and Industry Cycles

How The Economy Affects Your Business

The local and national economy not only affects your cash flow but also the value of your business. During an economic expansion, opportunity is ripe and almost all businesses look better to investors. During a recession, investors scrutinize a potential acquisition even more and will be pickier about details they may have considered inconsequential during an expansion. Other factors, such as population growth or increased regulation, will also affect your business’s value.

Just as the economy ebbs and flows, so does the value of your business. Your company may receive a lower valuation simply because of economic conditions—even if the business is more profitable!

It’s called a cycle for a reason. Nothing good lasts forever, and nothing bad lasts forever. Mike owned a staffing company. When times were bad, he couldn’t sell his business; when times were good, he didn’t want to sell, or he wanted a higher price than investors would pay. There’s an old saying, “Greed lowers IQ.” When times are good, don’t be too greedy.

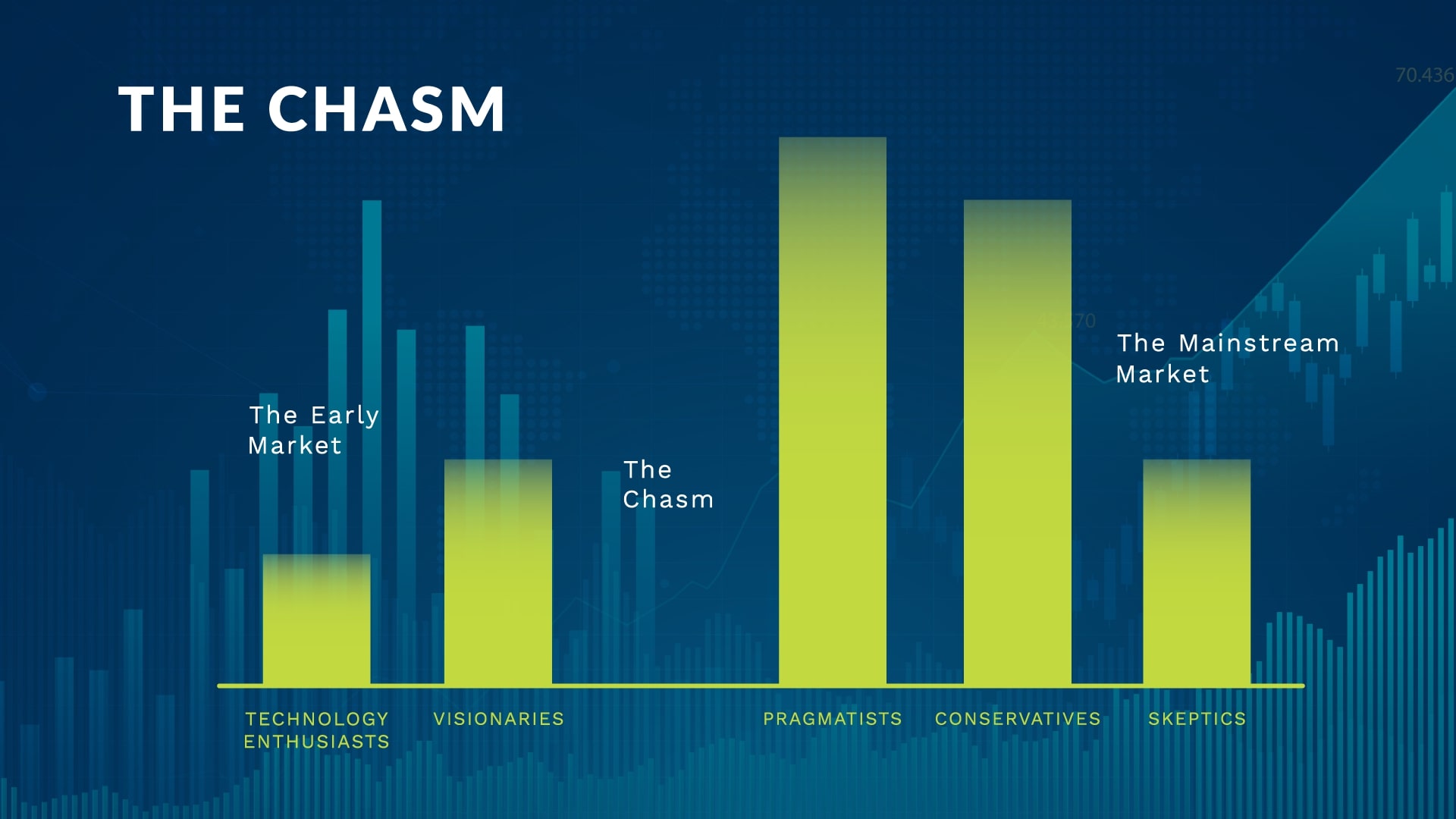

Another thing a seller must understand is the cycle of their industry.

With technology advancements, companies have had to adjust or die out. But most importantly, they need to understand where they are, in their industry, because that will affect their multiple when they choose to sell.

“When You’re Finished Changing, You’re Finished.”

If you had an IT consulting company fifteen years ago, you maintained clients’ servers on-site. Later, you had to evolve and purchased your own server to manage the clients from a remote location earning a monthly maintenance fee. Now, the Cloud is disrupting the server and companies that manage servers have to adjust. Microsoft is currently trying to compete with the Cloud and reinvent themselves with the creation of Office 365 and the recent purchase of LinkedIn. As a seller, it is imperative to know where your business stands with the local economy and specific industry. Regarding the above bell curve, if you sell on the upside, you will receive a higher multiple than if you sell on the “mature” side.

Conclusion

There are many factors that impact the value and marketability of your business. Some sound simple, but most can be extremely challenging to change. Not understanding and creating a plan to change or mitigate these risks can be devastating when it comes time to sell or exit the business.

Having gone through this process on our own and personally witnessing other entrepreneurs learn very painful lessons, our mission is to educate and teach entrepreneurs about the process and help them create a winning strategy to exit their business and monetize the years of hard work and sacrifice.

Whether you decide to market your company at this point or not, addressing these issues is imperative to maximizing your current value. Polish that apple to get the highest return on your hard work!