Dynamic Cash Flow Projections » Cash Flow Statement Projections

The Importance and Process of Projecting the Cash Flow Statement

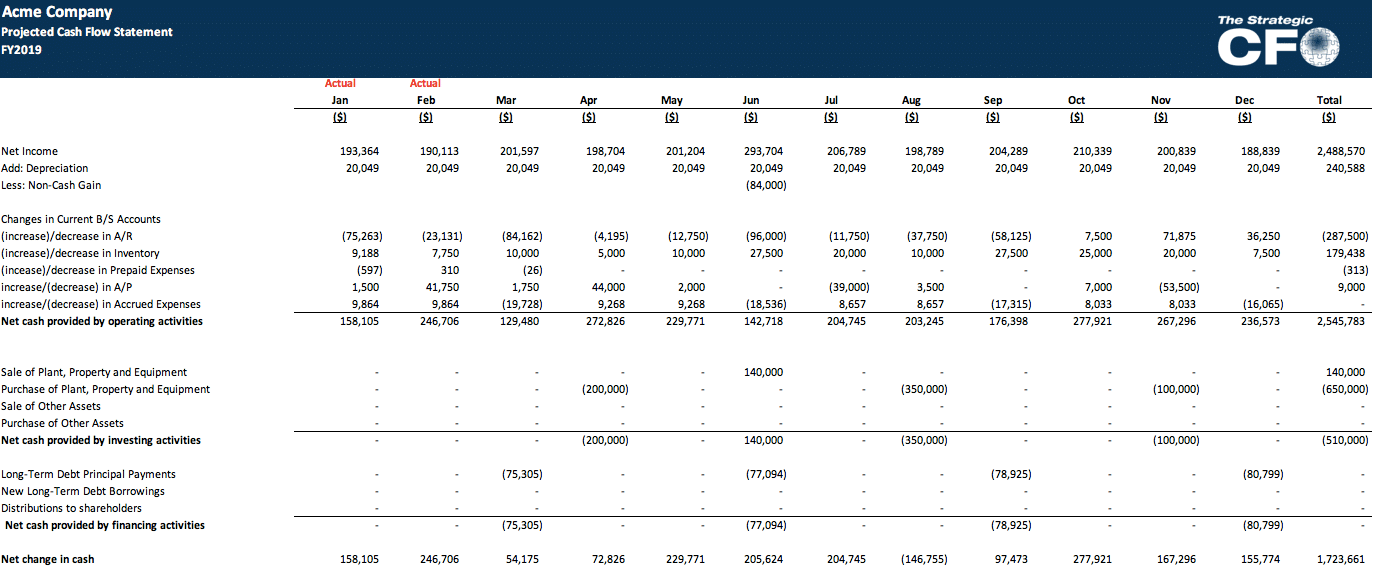

The Cash Flow Statement is a vital, though sometimes neglected, component of financial forecasting. It’s crucial for projecting working capital needs and giving owners and managers key insights into the business. The indirect method, also known as the Statement of Changes in Financial Position, is the most common approach used by financial professionals to create these projections.

The indirect method calculates cash flow from operations by taking net income and adjusting it for non-cash items and changes in working capital (current assets and liabilities). Because changes in these current accounts are essential for accurate operating cash flow calculations, the Balance Sheet projections must be established before creating the Cash Flow Statement.

A correctly structured Cash Flow Statement is critical. Once the format is set up properly, it enables the precise development of subsequent projections, such as the Balance Sheet. The change in cash derived from the Cash Flow Statement projections feeds directly into the cash balance reported on the Balance Sheet.

How To Project The Cash Flow Statement

Building a reliable Cash Flow Statement projection requires formulas in your financial model that are linked to relevant assumptions and data.

- Cash Flow from Operations: This section is derived from data on the Income Statement and the current asset and current liability sections of the Balance Sheet, reflecting changes in working capital.

- Cash Flow from Investing Activities: This primarily accounts for capital expenditures, investments, and the disposal of assets, all impacting the non-current asset section of the Balance Sheet.

- Cash Flow from Financing Activities: This section tracks movements related to non-current liabilities and shareholders’ equity, including loan repayments, debt issuance, and shareholder distributions.

For the Cash Flow from Investing and Cash Flow from Financing portion of the Cash Flow Statement projections, be primarily concerned with expected changes in the non-current Asset, non-current Liability and Shareholders’ Equity portions of the Balance Sheet.

Know when payments on your company’s long-term debt will be paid in the fiscal year. In addition, know when you will make large capital expenditures. Also know when distributions to shareholders typically take place.

When projecting the Cash Flow Statement, it’s essential to anticipate and incorporate expected long-term debt payments, capital expenditures, and shareholder distributions. This comprehensive approach ensures a strategic financial outlook, empowering management to make well-informed decisions.

Don’t forget that these transactions will impact both the Balance Sheet and the Cash Flow Statement.