Dynamic Cash Flow Projections » Update with Actuals

What Is The Purpose Of Updating With Actuals?

While financial projections are based on historical data, incorporating actual financial results each month (revenue, expenses, cash flow, etc.) is crucial for maintaining accuracy and utility.

Updating projections with actual data allows businesses to:

- Analyze Variances: Compare projected figures against actual performance to identify discrepancies and revise future expectations.

- Inform Decisions: Make strategic adjustments based on real-time data rather than relying solely on initial estimates.

- Support Compliance and Tax Planning: Maintain accurate financial statements for regulatory requirements and debt obligations.

Think of your cash flow projection as an arrow in flight; market conditions can alter its path, but continuous adjustments will increase the chances of it hitting that financial target.

How To Update With Actuals

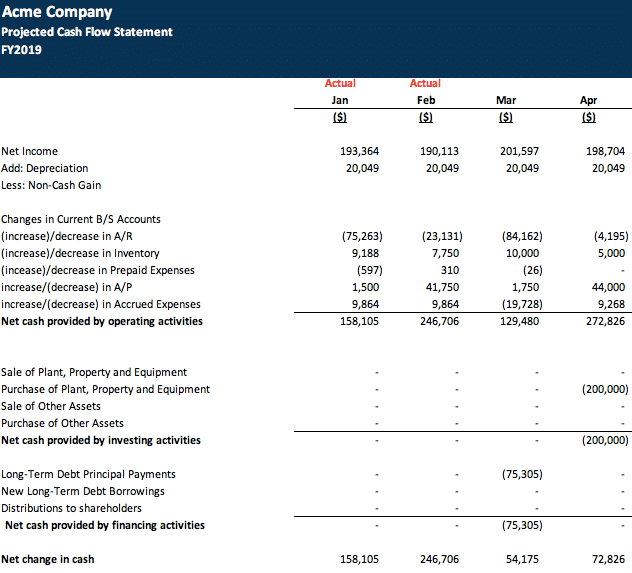

Each month you should drop in the actual results in the projections. By doing so the year end net income is a moving target. The assumptions that go into the sales and expense also change frequently. Consequently, every time you update the projections with actuals, you should also review assumptions for the remainder of the year. This procedure makes your projection “dynamic.”

- Input Actual Financials: Replace projected figures with verified data for revenue, expenses, assets, and cash flow as soon as they are available.

- Clearly Identify Actual Months: Mark months where actual data is used (e.g., by noting “Actual” above the month’s column).

- Refine Assumptions: As actual results replace estimates, adjust the assumptions used for projecting future months.

- Verify Balance Sheet Accuracy: Ensure the accounting equation (Total Assets = Total Liabilities + Equity) remains balanced after data entry.

How Often You Should Update With Actuals

Every time a month has closed and you have access to “real numbers”, you ought to drop in the actuals. Note though, that as soon as you drop in your actuals for the Income Statement and Cash Flow Statement, you will need to balance and review that period again to make sure that the Balance Sheet balances.

- Update monthly, once finalized financials are available.

- Each update necessitates verifying that the balance sheet remains reconciled.

- Projections transition into actual financial statements by year-end, critical for tax and compliance purposes.

By diligently updating projections, businesses can react quickly to changing financial conditions, improving their ability to meet financial objectives.

[gravityform id=”37″ title=”true” description=”true”]