Dynamic Cash Flow Projections » Accumulate Info

The Purpose of Accumulating Info

The Foundation of Financial Forecasting: Gathering Information

Creating dependable financial projections hinges on a thorough and organized approach to data collection. To produce trustworthy monthly forecasts, obtaining the most current and relevant financial data is crucial, as historical information forms the bedrock for all future estimates.

Financial Forecasting: Articulating Possibilities, Not Predicting the Future

Financial projections inherently rely on assumptions about future business performance. The goal isn’t to achieve pinpoint accuracy but to develop a reasonable and informed outlook that guides strategic planning and decision-making.

Think of financial forecasting like a meteorologist predicting the weather. The value isn’t in knowing the exact temperature days in advance but in providing a reliable range to inform decisions. Similarly, financial projections should offer a realistic view rather than a precise prediction.

The Ongoing Process: Data Collection Frequency

Developing a dynamic cash flow projection model initially requires significant time spent gathering financial data. However, this is not a one-time task. Unlike a static budget, financial projections should be continuously updated as new data emerges.

Regular updates ensure that management maintains an accurate grasp of the company’s financial course. Moreover, external stakeholders, like banks and investors, may require access to these insights.

A Structured Approach: Steps for Data Collection

- Collect Historical Financial Statements

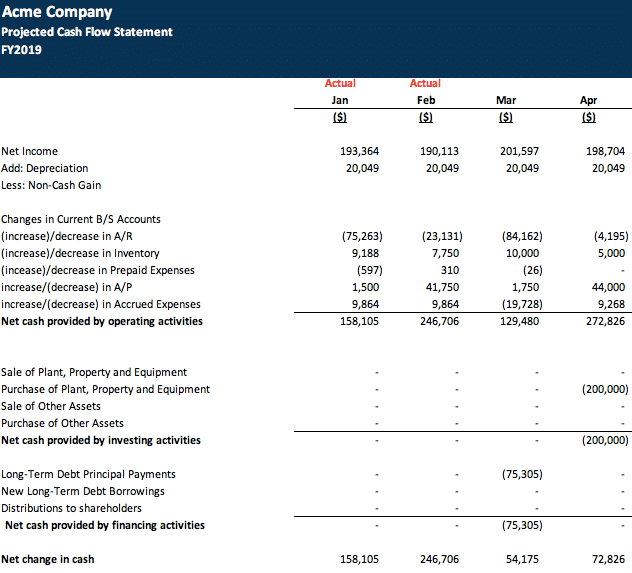

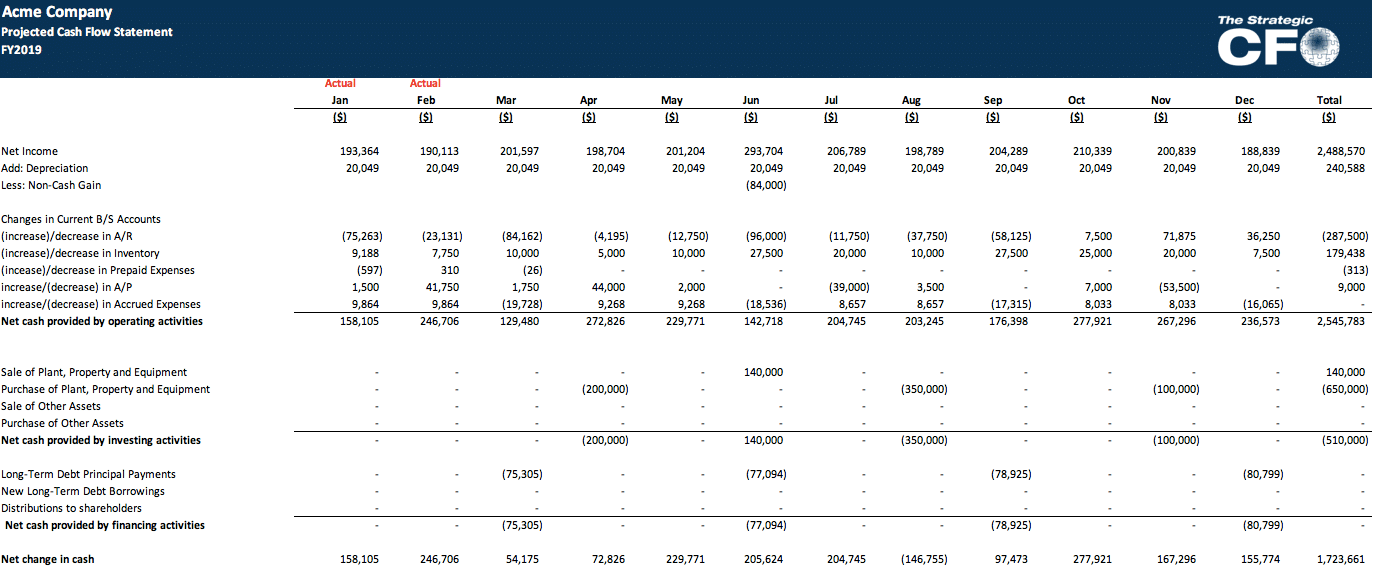

Begin building an effective projection model by gathering key financial documents from the previous fiscal period and year-to-date, including:- Income Statement

- Balance Sheet

- Cash Flow Statement

- These documents should be in Excel or a compatible spreadsheet format for easy integration into the projection model. Most accounting systems, such as QuickBooks, Peachtree, and Great Plains, allow for easy export to Excel.

- Standardize Formatting

Ensure consistent formatting across historical financial statements, as they form the basis for future projections. Aligning historical data with projected statements simplifies monthly updates and facilitates analysis. - Establish Realistic Assumptions

Projections should reflect realistic expectations for the next twelve months, considering seasonal trends and operational factors. For example, if sales typically peak during the summer and decline in the fall, incorporate those patterns into the forecast.

While projections don’t need to precisely mirror actual results, they should provide a structured and strategic framework for anticipating potential liquidity and operational challenges.

Key Forecasting Considerations

- Revenue Growth & Cost Alignment:

If revenue is expected to increase significantly, ensure Cost of Goods Sold (COGS) and Selling, General & Administrative (SG&A) expenses are adjusted proportionally to reflect the higher sales volume. - Capital Expenditures & Cash Flow Impact:

Projections should account for all major financial activities beyond revenue and expenses. If the company plans to invest in equipment, infrastructure, or other capital expenditures, these should be incorporated into the Balance Sheet and Cash Flow Statement projections.

By adopting a structured and forward-looking approach to financial forecasting, businesses can improve decision-making, mitigate risk, and optimize strategic planning for sustainable growth.