Accounting 101 » Statement of Cash Flows

The Cash Flow Statement shows the movement of cash and cash equivalents (like bank balances) over a specific period of time. It reflects how well a company manages its cash — what’s coming in, what’s going out, and where it’s going.

This statement is crucial for understanding liquidity — the cash available to meet obligations, fund operations, and invest in future growth.

The Three Sections of a Cash Flow Statement

Cash flow is categorized into three main activities:

1. Operating Activities

- Reflects cash generated or used in the company’s core business operations.

- Includes cash received from customers and cash paid to suppliers, employees, and for other operating expenses.

- This section answers:

Is the business generating enough cash from its day-to-day operations

2. Investing Activities

- Reflects cash used to purchase or earned from selling long-term assets, such as:

- Property, equipment, or machinery

- Investments in other companies

- Property, equipment, or machinery

- This section answers:

Is the company investing in its future? Or selling off assets to generate cash

3. Financing Activities

- Reflects cash movements related to raising or repaying capital:

- Issuing or repurchasing shares

- Borrowing funds (loans)

- Paying dividends or repaying debts

- Issuing or repurchasing shares

- This section answers:

How is the business funding its operations and growth

Why the Cash Flow Statement Matters

“How much money do we have available right now?”

The cash flow statement gives you the answer.

- Positive cash flow means your business has money on hand — to invest, pay bills, or weather downturns.

- Negative cash flow isn’t always bad (e.g., if you just invested in long-term growth), but it requires close monitoring.

The Cash Flow Statement in Context

The cash flow statement is one of the three core financial reports, alongside:

- Income Statement – Measures profitability over time

- Balance Sheet – Captures a snapshot of financial position at a specific moment

- Cash Flow Statement – Tracks actual cash movement over time

When viewed together, these statements give a complete picture of financial health.

Publicly traded companies are required to report all three statements quarterly to the SEC. Privately held companies benefit from doing the same for sound internal decision-making.

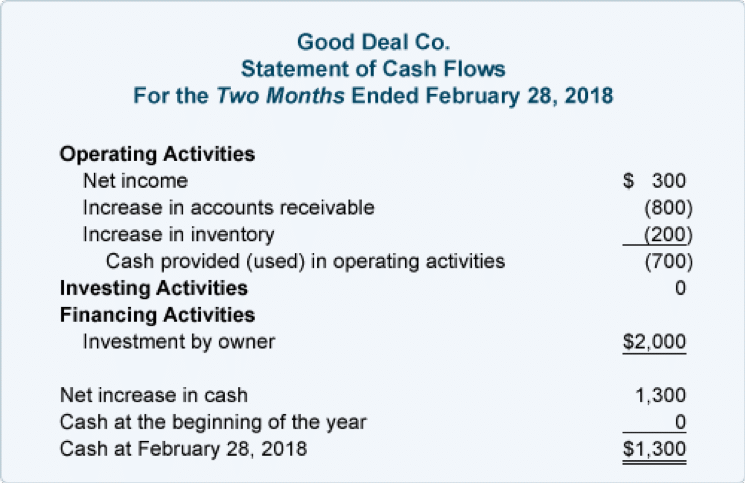

Cash Flow Statement Example